Summary

This paper investigates performance attribution measures as a basis for constraining portfolio optimization. We employ optimizations that minimize expected tail loss and investigate both asset allocation (AA) and the selection effect (SE) as hard constraints on asset weights. The test portfolio consists of stocks from the Dow Jones Industrial Average index; the benchmark is an equi-weighted portfolio of the same stocks. Performance of the optimized portfolios is judged using comparisons of cumulative price and the risk-measures maximum drawdown, Sharpe ratio, and Rachev ratio. The results suggest a positive role in price and risk-measure performance for the imposition of constraints on AA and SE, with SE constraints producing the larger performance enhancement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

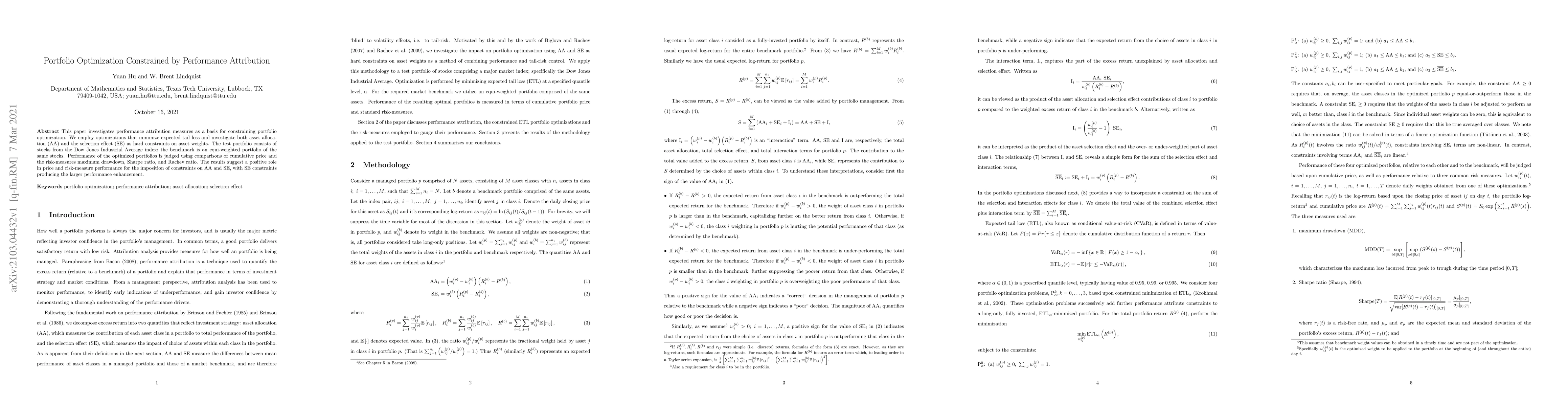

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCardinality-constrained Distributionally Robust Portfolio Optimization

Yuichi Takano, Ken Kobayashi, Kazuhide Nakata

| Title | Authors | Year | Actions |

|---|

Comments (0)