Summary

We consider a stochastic factor financial model where the asset price process and the process for the stochastic factor depend on an observable Markov chain and exhibit an affine structure. We are faced with a finite time investment horizon and derive optimal dynamic investment strategies that maximize the investor's expected utility from terminal wealth. To this aim we apply Merton's approach, as we are dealing with an incomplete market. Based on the semimartingale characterization of Markov chains we first derive the HJB equations, which in our case correspond to a system of coupled non-linear PDEs. Exploiting the affine structure of the model, we derive simple expressions for the solution in the case with no leverage, i.e. no correlation between the Brownian motions driving the asset price and the stochastic factor. In the presence of leverage we propose a separable ansatz, which leads to explicit solutions in this case as well. General verification results are also proved. The results are illustrated for the special case of a Markov modulated Heston model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

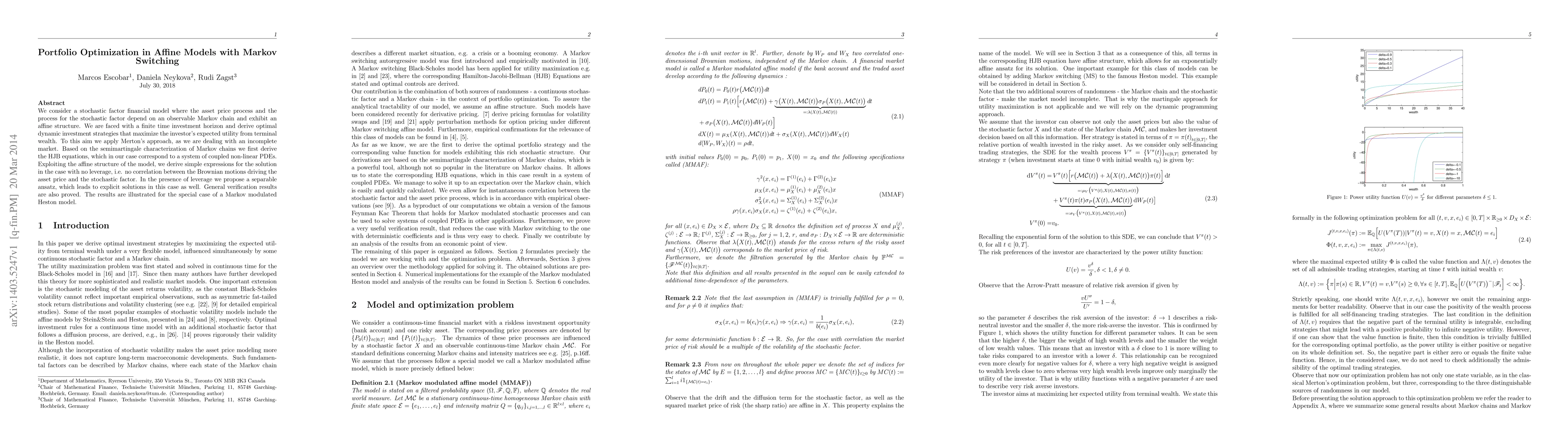

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)