Summary

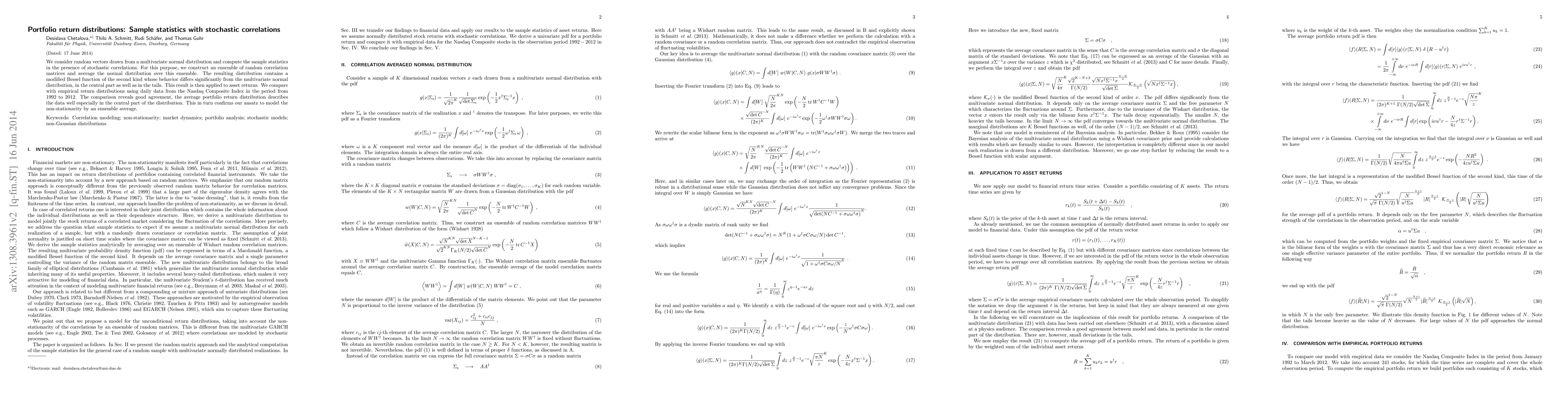

We consider random vectors drawn from a multivariate normal distribution and compute the sample statistics in the presence of non-stationary correlations. For this purpose, we construct an ensemble of random correlation matrices and average the normal distribution over this ensemble. The resulting distribution contains a modified Bessel function of the second kind whose behavior differs significantly from the multivariate normal distribution, in the central part as well as in the tails. This result is then applied to asset returns. We compare with empirical return distributions using daily data from the Nasdaq Composite Index in the period from 1992 to 2012. The comparison reveals good agreement, the average portfolio return distribution describes the data well especially in the central part of the distribution. This in turn confirms our ansatz to model the non-stationarity by an ensemble average.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA return-diversification approach to portfolio selection

Francesco Cesarone, Manuel Luis Martino, Rosella Giacometti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)