Summary

An investor with constant relative risk aversion and an infinite planning horizon trades a risky and a safe asset with constant investment opportunities, in the presence of small transaction costs and a binding exogenous portfolio constraint. We explicitly derive the optimal trading policy, its welfare, and implied trading volume. As an application, we study the problem of selecting a prime broker among alternatives with different lending rates and margin requirements. Moreover, we discuss how changing regulatory constraints affect the deposit rates offered for illiquid loans.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

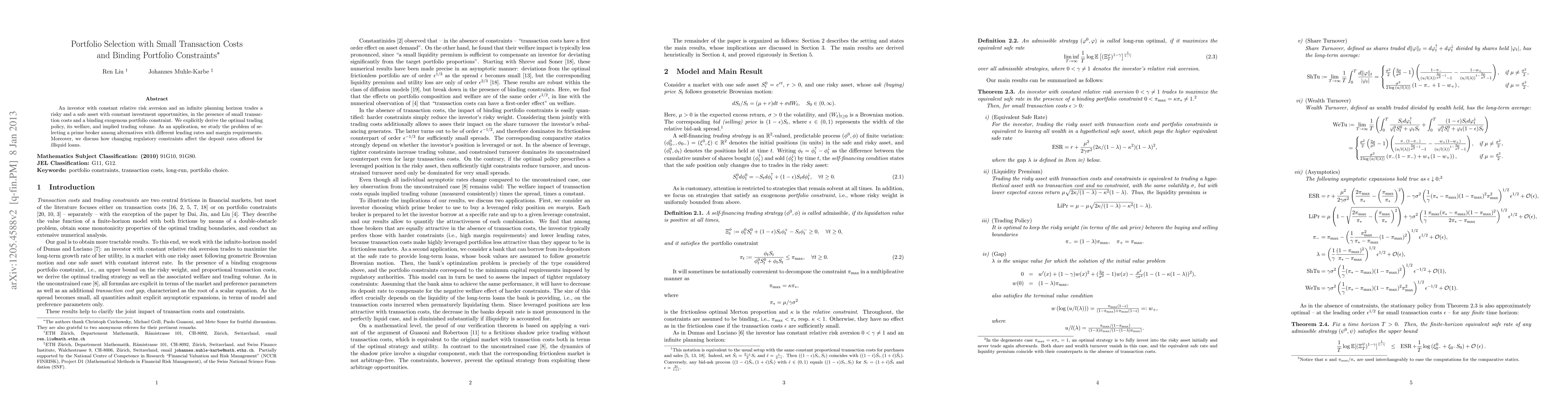

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Frequency-Based Optimal Portfolio with Transaction Costs

Chung-Han Hsieh, Yi-Shan Wong

| Title | Authors | Year | Actions |

|---|

Comments (0)