Summary

This survey is an introduction to asymptotic methods for portfolio-choice problems with small transaction costs. We outline how to derive the corresponding dynamic programming equations and simplify them in the small-cost limit. This allows to obtain explicit solutions in a wide range of settings, which we illustrate for a model with mean-reverting expected returns and proportional transaction costs. For even more complex models, we present a policy iteration scheme that allows to compute the solution numerically.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

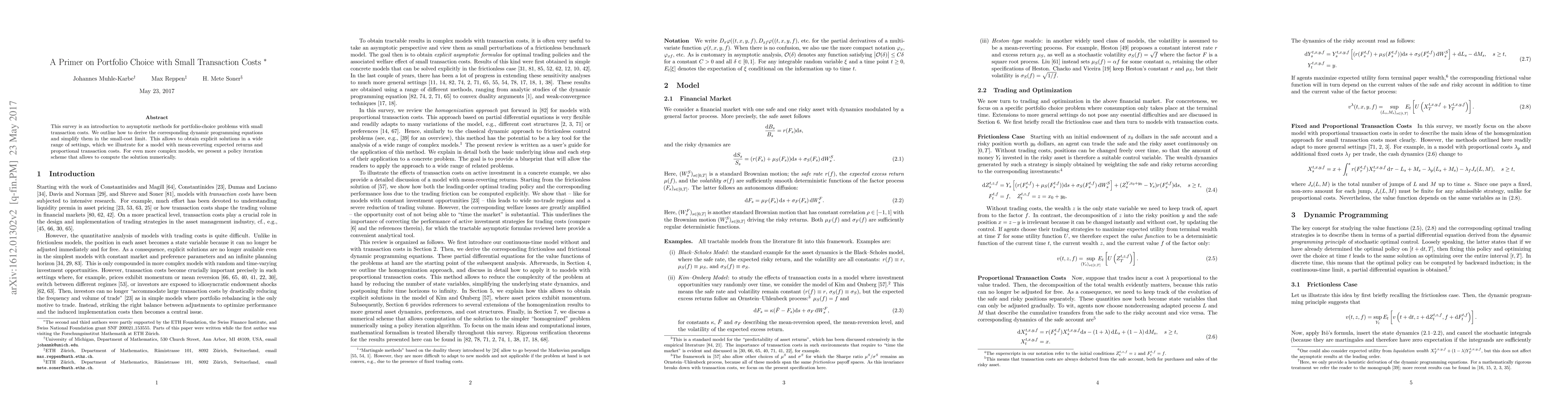

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)