Summary

Recent progress in portfolio choice has made a wide class of problems involving transaction costs tractable. We review the basic approach to these problems, and outline some directions for future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

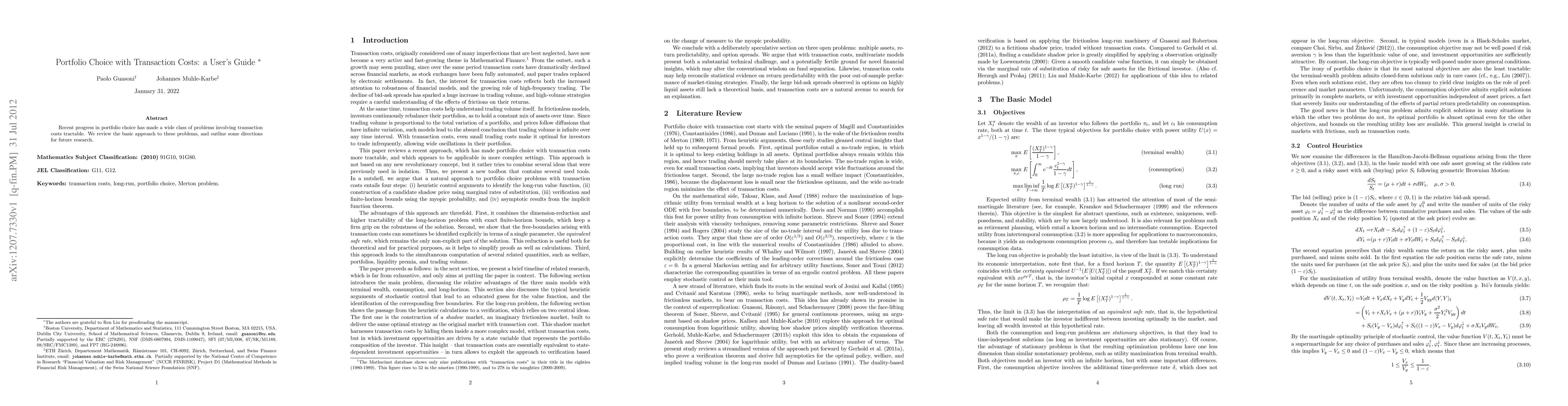

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Frequency-Based Optimal Portfolio with Transaction Costs

Chung-Han Hsieh, Yi-Shan Wong

| Title | Authors | Year | Actions |

|---|

Comments (0)