Summary

This survey reviews portfolio choice in settings where investment opportunities are stochastic due to, e.g., stochastic volatility or return predictability. It is explained how to heuristically compute candidate optimal portfolios using tools from stochastic control, and how to rigorously verify their optimality by means of convex duality. Special emphasis is placed on long-horizon asymptotics, that lead to particularly tractable results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

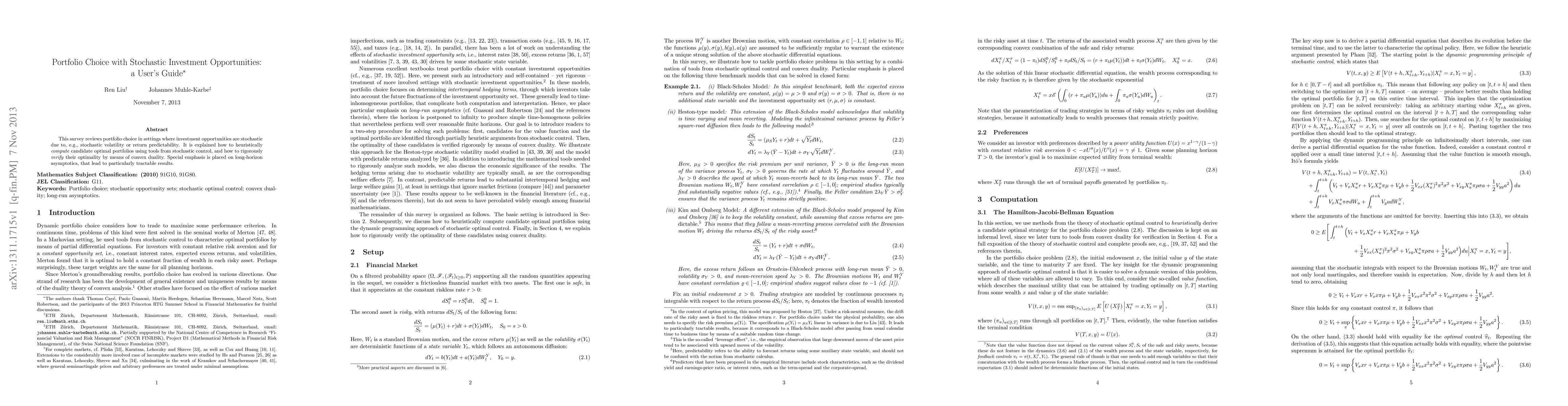

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChatGPT-based Investment Portfolio Selection

Oleksandr Romanko, Akhilesh Narayan, Roy H. Kwon

| Title | Authors | Year | Actions |

|---|

Comments (0)