Authors

Summary

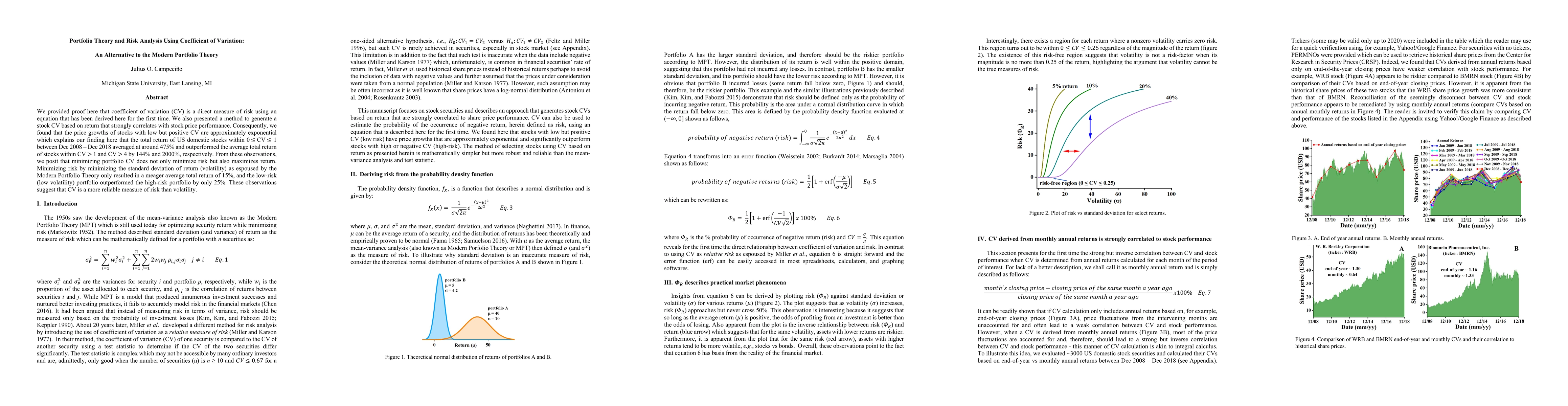

We provided proof here that coefficient of variation (CV) is a direct measure of risk using an equation that has been derived here for the first time. We also presented a method to generate a stock CV based on return that strongly correlates with stock price performance. Consequently, we found that the price growths of stocks with low but positive CV are approximately exponential which explains our finding here that the total return of US domestic stocks within $0 \le CV \le 1$ between Dec 2008 to Dec 2018 averaged at around 475% and outperformed the average total return of stocks within $CV > 1$ and $CV > 4$ by 144% and 2000%, respectively. From these observations, we posit that minimizing portfolio CV does not only minimize risk but also maximizes return. Minimizing risk by minimizing the standard deviation of return (volatility) as espoused by the Modern Portfolio Theory only resulted in a meager average total return of 15%, and the low-risk (low volatility) portfolio outperformed the high-risk portfolio by only 25%. These observations suggest that CV is a more reliable measure of risk than volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Comparative Analysis of Portfolio Optimization Using Mean-Variance, Hierarchical Risk Parity, and Reinforcement Learning Approaches on the Indian Stock Market

Jaydip Sen, Aditya Jaiswal, Anshuman Pathak et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)