Summary

It is now widely accepted that, to model the dynamics of daily financial returns, volatility models have to incorporate the so-called leverage effect. We derive the asymptotic behaviour of the squared residuals autocovariances for the class of asymmetric power GARCH model when the power is unknown and is jointly estimated with the model's parameters. We then deduce a portmanteau adequacy test based on the autocovariances of the squared residuals. These asymptotic results are illustrated by Monte Carlo experiments. An application to real financial data is also proposed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

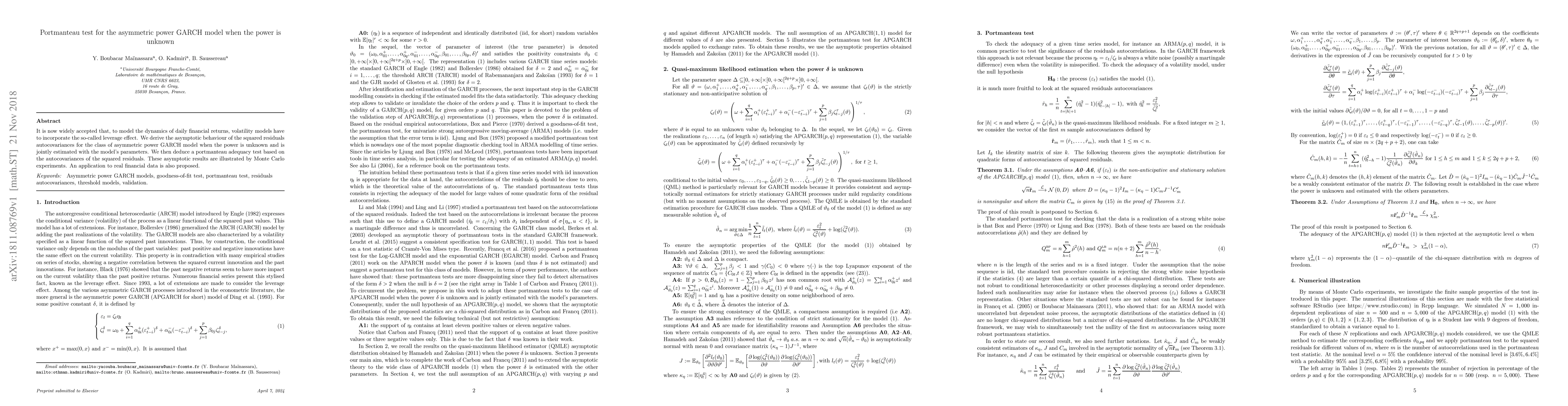

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortmanteau test for a class of multivariate asymmetric power GARCH model

Yacouba Boubacar Maïnassara, Bruno Saussereau, Othman Kadmiri

| Title | Authors | Year | Actions |

|---|

Comments (0)