Authors

Summary

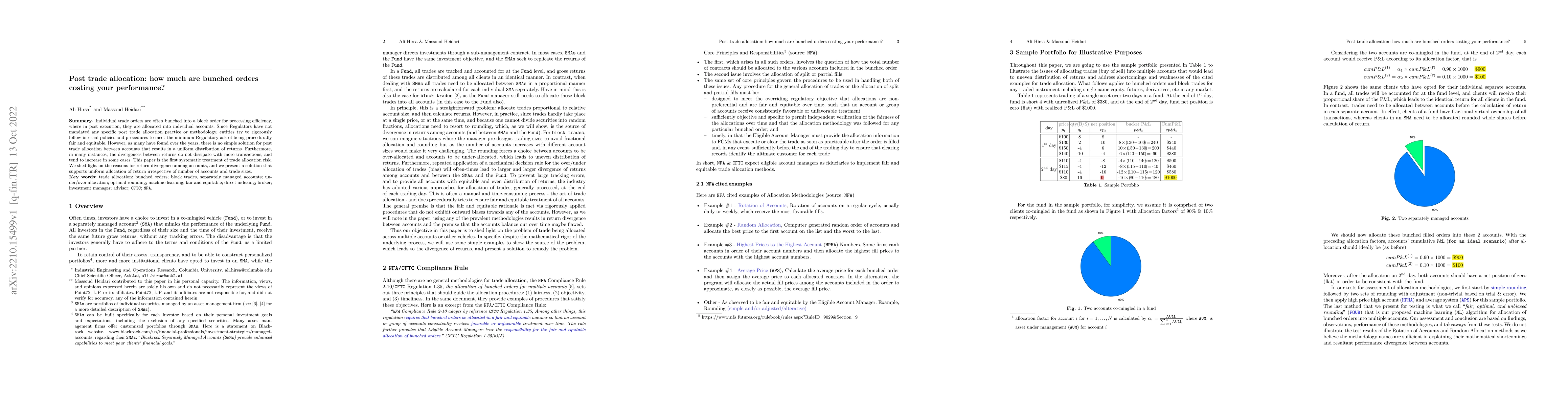

Individual trade orders are often bunched into a block order for processing efficiency, where in post execution, they are allocated into individual accounts. Since Regulators have not mandated any specific post trade allocation practice or methodology, entities try to rigorously follow internal policies and procedures to meet the minimum Regulatory ask of being procedurally fair and equitable. However, as many have found over the years, there is no simple solution for post trade allocation between accounts that results in a uniform distribution of returns. Furthermore, in many instances, the divergences between returns do not dissipate with more transactions, and tend to increase in some cases. This paper is the first systematic treatment of trade allocation risk. We shed light on the reasons for return divergence among accounts, and we present a solution that supports uniform allocation of return irrespective of number of accounts and trade sizes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBrainBits: How Much of the Brain are Generative Reconstruction Methods Using?

Andrei Barbu, Christopher Wang, Boris Katz et al.

How disentangled are your classification uncertainties?

Matias Valdenegro-Toro, Ivo Pascal de Jong, Andreea Ioana Sburlea

No citations found for this paper.

Comments (0)