Authors

Summary

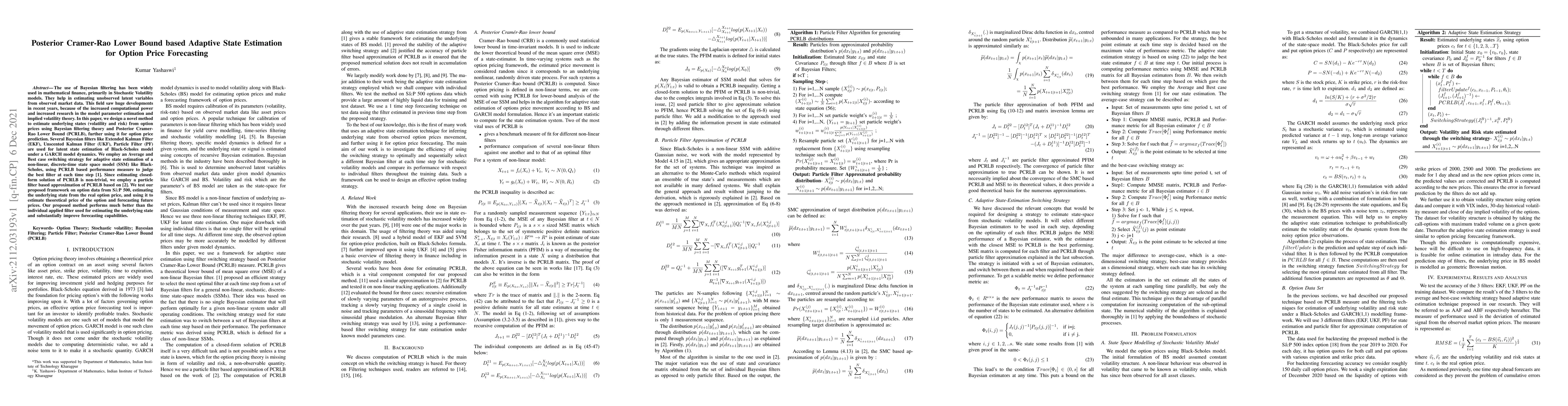

The use of Bayesian filtering has been widely used in mathematical finance, primarily in Stochastic Volatility models. They help in estimating unobserved latent variables from observed market data. This field saw huge developments in recent years, because of the increased computational power and increased research in the model parameter estimation and implied volatility theory. In this paper, we design a novel method to estimate underlying states (volatility and risk) from option prices using Bayesian filtering theory and Posterior Cramer-Rao Lower Bound (PCRLB), further using it for option price prediction. Several Bayesian filters like Extended Kalman Filter (EKF), Unscented Kalman Filter (UKF), Particle Filter (PF) are used for latent state estimation of Black-Scholes model under a GARCH model dynamics. We employ an Average and Best case switching strategy for adaptive state estimation of a non-linear, discrete-time state space model (SSM) like Black-Scholes, using PCRLB based performance measure to judge the best filter at each time step [1]. Since estimating closed-form solution of PCRLB is non-trivial, we employ a particle filter based approximation of PCRLB based on [2]. We test our proposed framework on option data from S$\&$P 500, estimating the underlying state from the real option price, and using it to estimate theoretical price of the option and forecasting future prices. Our proposed method performs much better than the individual applied filter used for estimating the underlying state and substantially improve forecasting capabilities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)