Summary

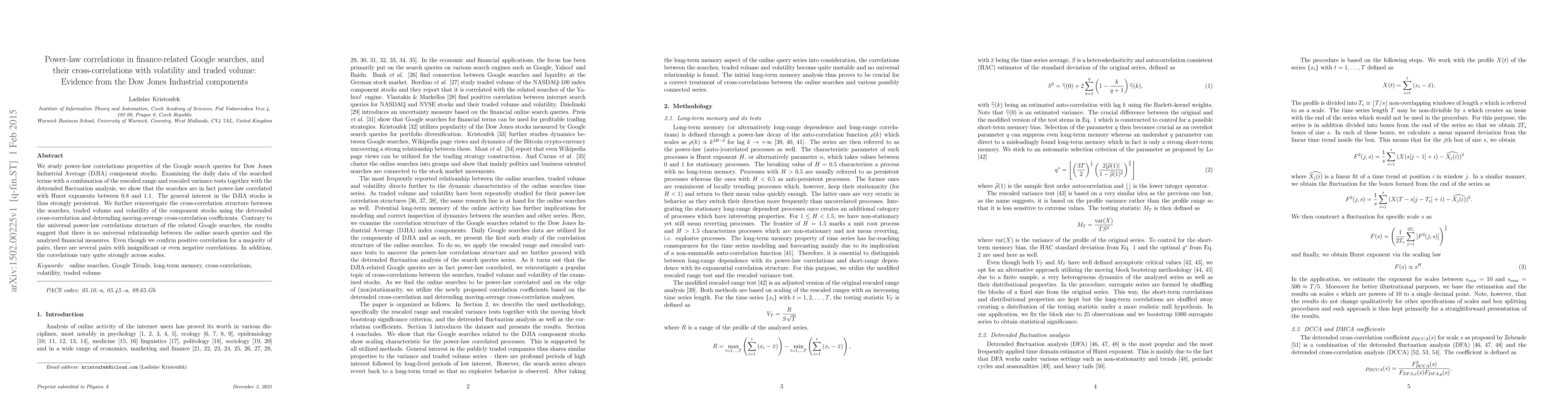

We study power-law correlations properties of the Google search queries for Dow Jones Industrial Average (DJIA) component stocks. Examining the daily data of the searched terms with a combination of the rescaled range and rescaled variance tests together with the detrended fluctuation analysis, we show that the searches are in fact power-law correlated with Hurst exponents between 0.8 and 1.1. The general interest in the DJIA stocks is thus strongly persistent. We further reinvestigate the cross-correlation structure between the searches, traded volume and volatility of the component stocks using the detrended cross-correlation and detrending moving-average cross-correlation coefficients. Contrary to the universal power-law correlations structure of the related Google searches, the results suggest that there is no universal relationship between the online search queries and the analyzed financial measures. Even though we confirm positive correlation for a majority of pairs, there are several pairs with insignificant or even negative correlations. In addition, the correlations vary quite strongly across scales.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)