Summary

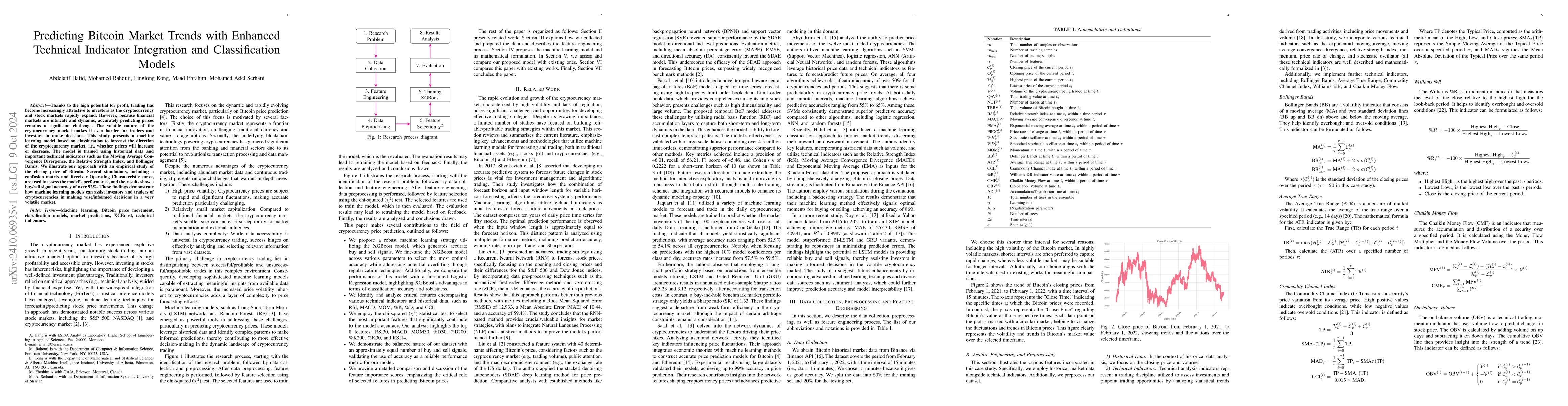

Thanks to the high potential for profit, trading has become increasingly attractive to investors as the cryptocurrency and stock markets rapidly expand. However, because financial markets are intricate and dynamic, accurately predicting prices remains a significant challenge. The volatile nature of the cryptocurrency market makes it even harder for traders and investors to make decisions. This study presents a machine learning model based on classification to forecast the direction of the cryptocurrency market, i.e., whether prices will increase or decrease. The model is trained using historical data and important technical indicators such as the Moving Average Convergence Divergence, the Relative Strength Index, and Bollinger Bands. We illustrate our approach with an empirical study of the closing price of Bitcoin. Several simulations, including a confusion matrix and Receiver Operating Characteristic curve, are used to assess the model's performance, and the results show a buy/sell signal accuracy of over 92%. These findings demonstrate how machine learning models can assist investors and traders of cryptocurrencies in making wise/informed decisions in a very volatile market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUsing Sentiment and Technical Analysis to Predict Bitcoin with Machine Learning

Arthur Emanuel de Oliveira Carosia

Functional Classification of Bitcoin Addresses

Manuel Febrero-Bande, Yuri F. Saporito, Wenceslao González-Manteiga et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)