Summary

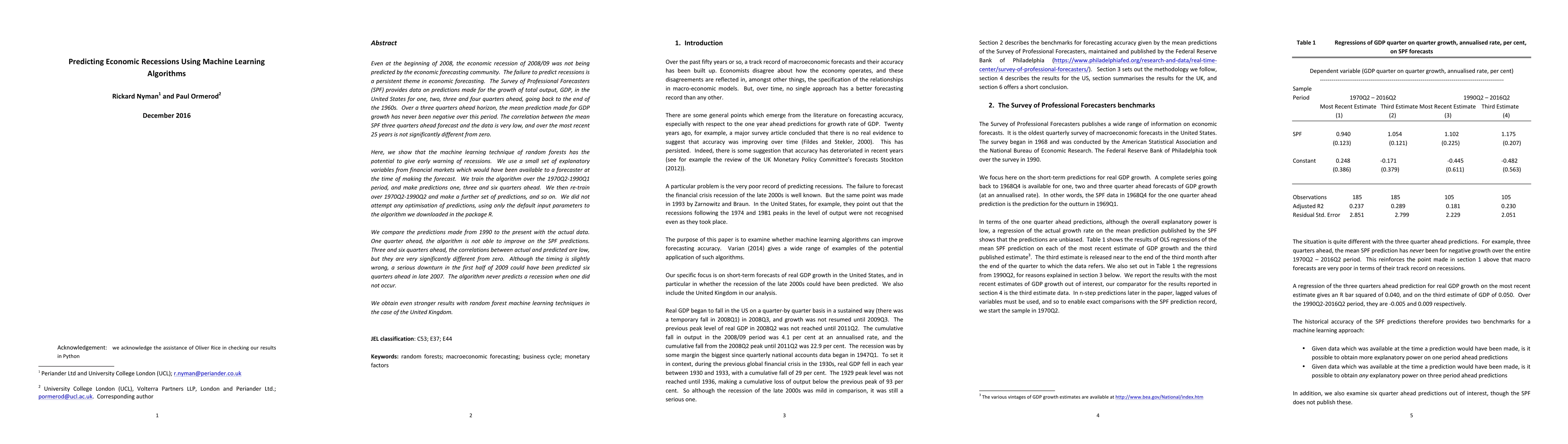

Even at the beginning of 2008, the economic recession of 2008/09 was not being predicted. The failure to predict recessions is a persistent theme in economic forecasting. The Survey of Professional Forecasters (SPF) provides data on predictions made for the growth of total output, GDP, in the United States for one, two, three and four quarters ahead since the end of the 1960s. Over a three quarters ahead horizon, the mean prediction made for GDP growth has never been negative over this period. The correlation between the mean SPF three quarters ahead forecast and the data is very low, and over the most recent 25 years is not significantly different from zero. Here, we show that the machine learning technique of random forests has the potential to give early warning of recessions. We use a small set of explanatory variables from financial markets which would have been available to a forecaster at the time of making the forecast. We train the algorithm over the 1970Q2-1990Q1 period, and make predictions one, three and six quarters ahead. We then re-train over 1970Q2-1990Q2 and make a further set of predictions, and so on. We did not attempt any optimisation of predictions, using only the default input parameters to the algorithm we downloaded in the package R. We compare the predictions made from 1990 to the present with the actual data. One quarter ahead, the algorithm is not able to improve on the SPF predictions. Three and six quarters ahead, the correlations between actual and predicted are low, but they are very significantly different from zero. Although the timing is slightly wrong, a serious downturn in the first half of 2009 could have been predicted six quarters ahead in late 2007. The algorithm never predicts a recession when one did not occur. We obtain even stronger results with random forest machine learning techniques in the case of the United Kingdom.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting radiation-acute esophagitis via machine learning algorithms.

Khodaei, Amin, Alizade-Harakiyan, Mostafa, Zamani, Hamed et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)