Authors

Summary

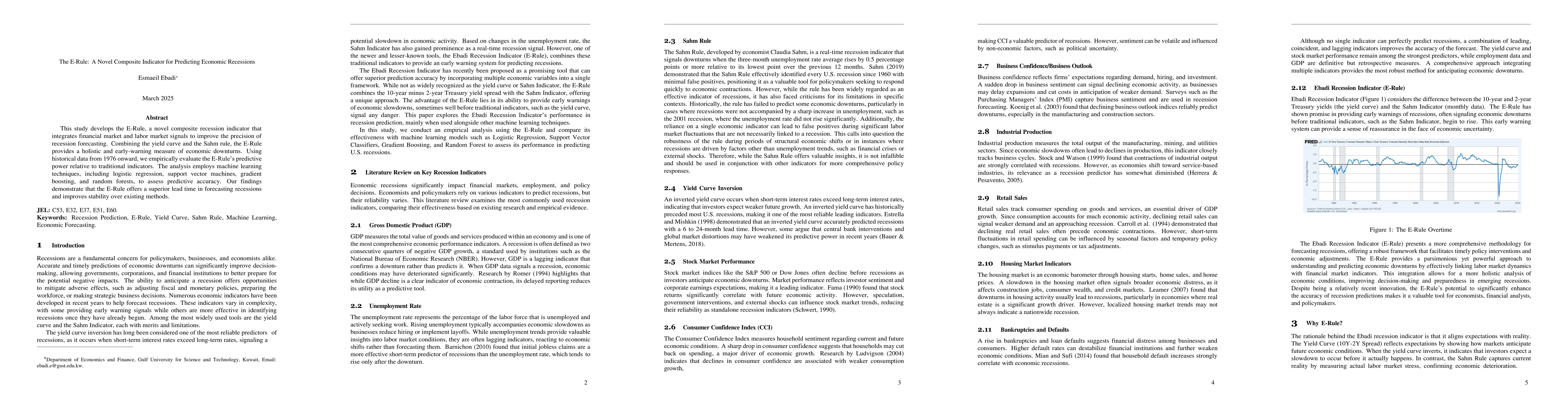

This study develops the E-Rule, a novel composite recession indicator that integrates financial market and labor market signals to improve the precision of recession forecasting. Combining the yield curve and the Sahm rule, the E-Rule provides a holistic and early-warning measure of economic downturns. Using historical data from 1976 onward, we empirically evaluate the E-Rule's predictive power relative to traditional indicators. The analysis employs machine learning techniques, including logistic regression, support vector machines, gradient boosting, and random forests, to assess predictive accuracy. Our findings demonstrate that the E-Rule offers a superior lead time in forecasting recessions and improves stability over existing methods.

AI Key Findings

Generated Jun 10, 2025

Methodology

This study develops the E-Rule, a composite recession indicator integrating financial market signals (yield curve) and labor market stress measures (Sahm Rule), using historical data from 1976 and machine learning techniques like logistic regression, support vector machines, gradient boosting, and random forests.

Key Results

- The E-Rule provides a holistic and early-warning measure of economic downturns, offering a superior lead time in forecasting recessions compared to traditional indicators.

- The E-Rule demonstrates improved stability and accuracy in predicting recessions, with an optimized threshold range of -0.2 to 0.2 achieving 86.5% accuracy and -0.3 to 0.3 reaching 92.7% accuracy.

- Machine learning models, including Logistic Regression, Support Vector Classifier, Gradient Boosting, and Random Forest, show high predictive accuracy when trained with the Ebadi Recession Indicator.

Significance

The E-Rule represents a significant advancement in economic forecasting, offering a reliable tool for policymakers, financial analysts, and businesses to anticipate and mitigate recessionary risks.

Technical Contribution

The development of the E-Rule, a novel composite indicator that combines financial market and labor market signals to improve recession forecasting precision.

Novelty

The E-Rule bridges the gap between market expectations and economic reality, offering a more accurate and early warning system for economic downturns compared to traditional indicators.

Limitations

- The study does not explore the applicability of the E-Rule across different economic cycles and regions.

- Further refinements could enhance the effectiveness of the E-Rule, such as integrating additional macroeconomic indicators.

Future Work

- Explore the integration of more macroeconomic indicators to improve the E-Rule's predictive power.

- Test the E-Rule's applicability across various economic cycles and regions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Novel Composite Resilience Indicator for Decentralized Infrastructure Systems (CRI-DS)

Lamis Amer, Murat Erkoc, Esber Andiroglu et al.

No citations found for this paper.

Comments (0)