Summary

Financial bond yield forecasting is challenging due to data scarcity, nonlinear macroeconomic dependencies, and evolving market conditions. In this paper, we propose a novel framework that leverages Causal Generative Adversarial Networks (CausalGANs) and Soft Actor-Critic (SAC) reinforcement learning (RL) to generate high-fidelity synthetic bond yield data for four major bond categories (AAA, BAA, US10Y, Junk). By incorporating 12 key macroeconomic variables, we ensure statistical fidelity by preserving essential market properties. To transform this market dependent synthetic data into actionable insights, we employ a finetuned Large Language Model (LLM) Qwen2.5-7B that generates trading signals (BUY/HOLD/SELL), risk assessments, and volatility projections. We use automated, human and LLM evaluations, all of which demonstrate that our framework improves forecasting performance over existing methods, with statistical validation via predictive accuracy, MAE evaluation(0.103%), profit/loss evaluation (60% profit rate), LLM evaluation (3.37/5) and expert assessments scoring 4.67 out of 5. The reinforcement learning-enhanced synthetic data generation achieves the least Mean Absolute Error of 0.103, demonstrating its effectiveness in replicating real-world bond market dynamics. We not only enhance data-driven trading strategies but also provides a scalable, high-fidelity synthetic financial data pipeline for risk & volatility management and investment decision-making. This work establishes a bridge between synthetic data generation, LLM driven financial forecasting, and language model evaluation, contributing to AI-driven financial decision-making.

AI Key Findings

Generated Jun 11, 2025

Methodology

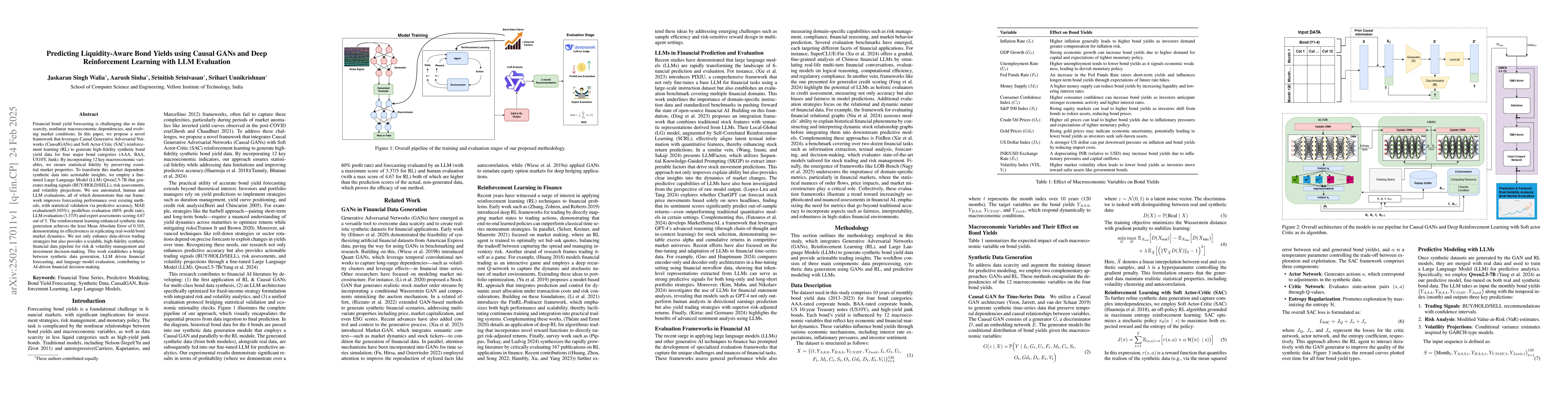

The research proposes a framework that combines Causal Generative Adversarial Networks (CausalGANs) and Soft Actor-Critic (SAC) reinforcement learning for generating synthetic bond yield data, followed by predictive analysis using a fine-tuned Large Language Model (LLM) Qwen2.5-7B.

Key Results

- The framework improves forecasting performance over existing methods with statistical validation via predictive accuracy, MAE evaluation (0.103%), profit/loss evaluation (60% profit rate), and LLM evaluation (3.37/5).

- The reinforcement learning-enhanced synthetic data generation achieves the least Mean Absolute Error of 0.103, demonstrating its effectiveness in replicating real-world bond market dynamics.

- Expert assessments scored 4.67 out of 5, indicating high practical viability.

Significance

This work establishes a bridge between synthetic data generation, LLM-driven financial forecasting, and language model evaluation, contributing to AI-driven financial decision-making by enhancing data-driven trading strategies and providing a scalable, high-fidelity synthetic financial data pipeline for risk & volatility management and investment decision-making.

Technical Contribution

The novel integration of CausalGANs, SAC reinforcement learning, and a fine-tuned LLM for predictive analytics in financial bond yield forecasting.

Novelty

The research combines causal GANs and SAC reinforcement learning for synthetic data generation, followed by LLM-driven predictive modeling, which hasn't been extensively explored in financial forecasting.

Limitations

- Large Language Models (LLMs) have inherent limitations in accurately predicting future outcomes, especially in dynamic and uncertain environments.

- The forecasting approach does not fully account for significant risk factors associated with market fluctuations and external uncertainties.

Future Work

- Further refine generative models and incorporate additional macroeconomic factors.

- Extend the framework to other financial instruments and market conditions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImproving DeFi Accessibility through Efficient Liquidity Provisioning with Deep Reinforcement Learning

Haonan Xu, Alessio Brini

Causal-Paced Deep Reinforcement Learning

Sundong Kim, Doyoon Kim, Jaegyun Im et al.

Adaptive Liquidity Provision in Uniswap V3 with Deep Reinforcement Learning

Xi Chen, Lin F. Yang, Haochen Zhang

Causal Deep Reinforcement Learning Using Observational Data

Qiang Zhang, Chao Yu, Wenxuan Zhu

No citations found for this paper.

Comments (0)