Summary

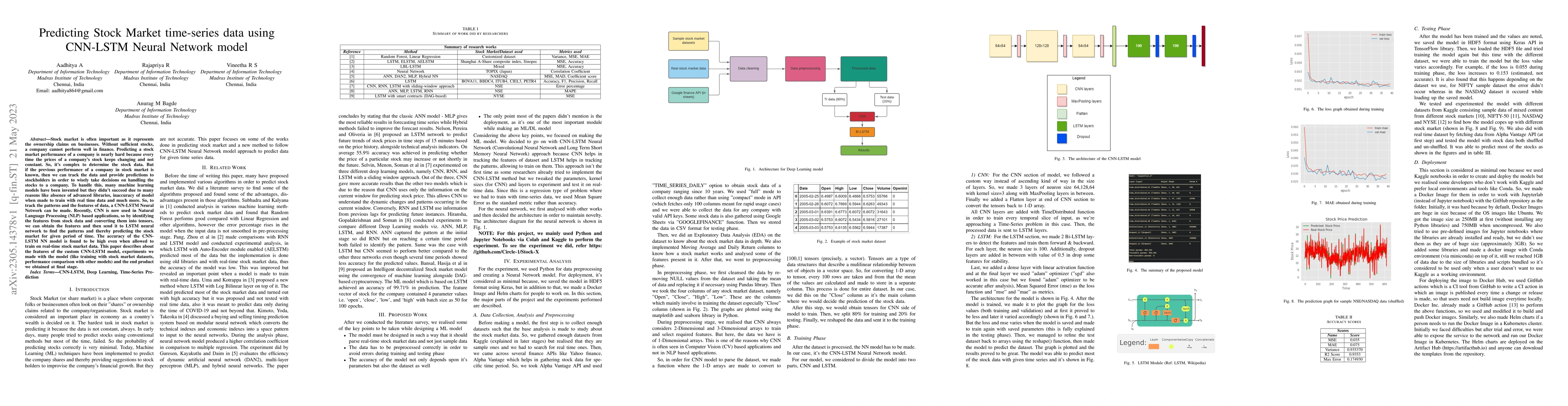

Stock market is often important as it represents the ownership claims on businesses. Without sufficient stocks, a company cannot perform well in finance. Predicting a stock market performance of a company is nearly hard because every time the prices of a company stock keeps changing and not constant. So, its complex to determine the stock data. But if the previous performance of a company in stock market is known, then we can track the data and provide predictions to stockholders in order to wisely take decisions on handling the stocks to a company. To handle this, many machine learning models have been invented but they didn't succeed due to many reasons like absence of advanced libraries, inaccuracy of model when made to train with real time data and much more. So, to track the patterns and the features of data, a CNN-LSTM Neural Network can be made. Recently, CNN is now used in Natural Language Processing (NLP) based applications, so by identifying the features from stock data and converting them into tensors, we can obtain the features and then send it to LSTM neural network to find the patterns and thereby predicting the stock market for given period of time. The accuracy of the CNN-LSTM NN model is found to be high even when allowed to train on real-time stock market data. This paper describes about the features of the custom CNN-LSTM model, experiments we made with the model (like training with stock market datasets, performance comparison with other models) and the end product we obtained at final stage.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research employs a CNN-LSTM neural network model to predict stock market time-series data. The dataset is collected from stock market APIs and Google Sheets, covering a 10-year period. The data undergoes exploratory data analysis, feature engineering, and preprocessing before being fed into the CNN-LSTM model. The model is divided into CNN and LSTM sections, with custom layer configurations and dropout layers for stability. The model is trained, validated, and tested, with performance metrics such as MSE, MAE, R2 score, and max error recorded.

Key Results

- The CNN-LSTM model demonstrates high accuracy in predicting stock market data, even when trained on real-time data.

- The model successfully identifies patterns and features in the stock market data, outperforming simpler models like LSTM and XGBoost in terms of MSE and MAE.

- The model achieves an average MSE of 0.035 and a maximum MSE of 0.17493 across various datasets, including NIFTY, NASDAQ, NYSE, BSE, and real-time IBM data.

- The model's performance varies depending on the dataset, with better accuracy for NIFTY (99%) compared to NYSE and NASDAQ datasets.

- The model's predictions are robust and can handle both shuffled and unshuffled stock data.

Significance

This research is significant as it proposes a novel approach to stock market prediction using a CNN-LSTM neural network, which effectively captures temporal dependencies and spatial features in stock market time-series data. The model's high accuracy and robustness make it a valuable tool for investors and financial analysts, potentially improving decision-making processes in the stock market.

Technical Contribution

The primary technical contribution of this research is the development and implementation of a custom CNN-LSTM neural network model for stock market time-series prediction. This model effectively combines the strengths of CNNs in feature extraction and LSTM in capturing temporal dependencies, resulting in high-accuracy predictions.

Novelty

This work stands out due to its focus on applying a CNN-LSTM model to stock market prediction, a domain where traditional machine learning models have shown limited success. The proposed model's unique architecture and high predictive accuracy distinguish it from existing approaches, offering a promising alternative for stock market forecasting.

Limitations

- The model's performance may vary depending on the dataset, with some datasets (e.g., NASDAQ) showing higher error rates when the saved model is retrained with different data.

- The model's accuracy could be affected by noise in the dataset, particularly during the testing phase.

- The model's reliance on historical data may limit its predictive power during unprecedented market events or crises (e.g., COVID-19 pandemic).

Future Work

- Investigate methods to reduce the model's sensitivity to dataset variations and improve its generalization capabilities.

- Explore techniques to incorporate external factors (e.g., economic indicators, news sentiment) that may impact stock market performance.

- Develop strategies to enhance the model's performance during unprecedented market events or crises.

- Investigate the use of transfer learning or other advanced techniques to improve the model's adaptability to new stocks or markets.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAttention-based CNN-LSTM and XGBoost hybrid model for stock prediction

Jian Wu, Yang Hu, Zhuangwei Shi et al.

Stock Price Prediction Using a Hybrid LSTM-GNN Model: Integrating Time-Series and Graph-Based Analysis

Armin Moin, Atta Badii, Meet Satishbhai Sonani

| Title | Authors | Year | Actions |

|---|

Comments (0)