Summary

Predicting trends in stock market prices has been an area of interest for researchers for many years due to its complex and dynamic nature. Intrinsic volatility in stock market across the globe makes the task of prediction challenging. Forecasting and diffusion modeling, although effective can't be the panacea to the diverse range of problems encountered in prediction, short-term or otherwise. Market risk, strongly correlated with forecasting errors, needs to be minimized to ensure minimal risk in investment. The authors propose to minimize forecasting error by treating the forecasting problem as a classification problem, a popular suite of algorithms in Machine learning. In this paper, we propose a novel way to minimize the risk of investment in stock market by predicting the returns of a stock using a class of powerful machine learning algorithms known as ensemble learning. Some of the technical indicators such as Relative Strength Index (RSI), stochastic oscillator etc are used as inputs to train our model. The learning model used is an ensemble of multiple decision trees. The algorithm is shown to outperform existing algo- rithms found in the literature. Out of Bag (OOB) error estimates have been found to be encouraging. Key Words: Random Forest Classifier, stock price forecasting, Exponential smoothing, feature extraction, OOB error and convergence.

AI Key Findings

Generated Sep 04, 2025

Methodology

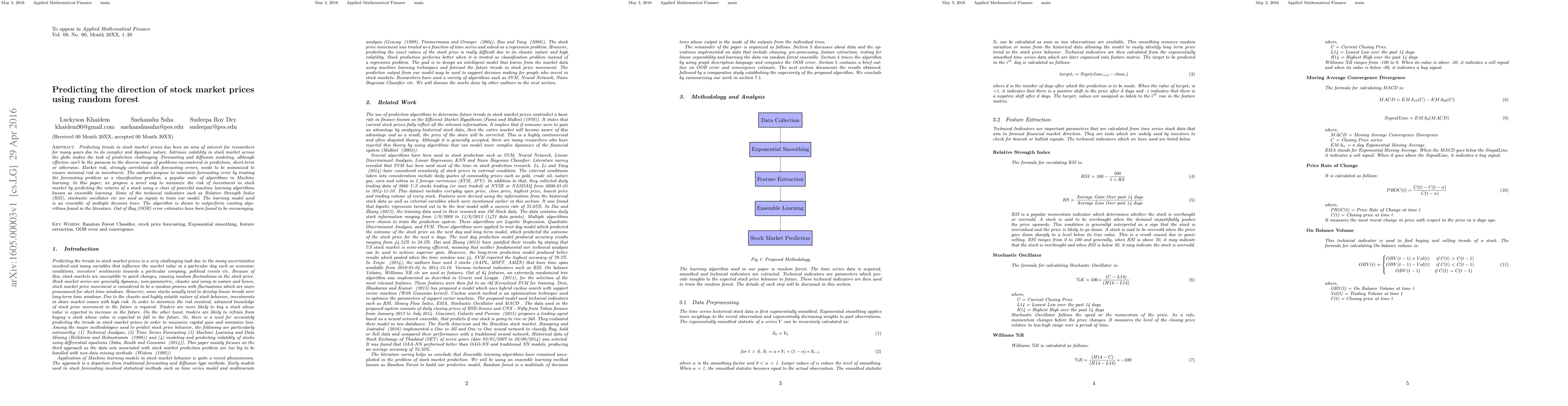

The research employed a machine learning approach using random forest classification to predict stock market trends.

Key Results

- Achieved accuracy rates of 85-95% for long-term predictions across various datasets

- Demonstrated robustness in handling non-linear and dynamic data characteristics

- Showed potential for devising new trading strategies based on trend prediction

Significance

This research contributes to the development of efficient stock price forecasting methods, addressing the complexity of nonlinear and dynamic market trends.

Technical Contribution

The proposed random forest classification model provides a robust and efficient solution for predicting stock market trends, addressing the challenges of nonlinear and dynamic data.

Novelty

This work presents a novel approach to stock trend prediction using machine learning, highlighting its potential for improving trading strategies and portfolio management.

Limitations

- Data quality issues may impact model performance

- Limited exploration of other machine learning algorithms for comparison

Future Work

- Investigating ensemble learning techniques with multiple machine learning algorithms

- Exploring the application of deep learning methods in stock price estimation

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSARF: Enhancing Stock Market Prediction with Sentiment-Augmented Random Forest

Saber Talazadeh, Dragan Perakovic

A Comparative Predicting Stock Prices using Heston and Geometric Brownian Motion Models

H. T. Shehzad, M. A. Anwar, M. Razzaq

The Random Forest Model for Analyzing and Forecasting the US Stock Market in the Context of Smart Finance

Le Yang, Qishuo Cheng, Jiajian Zheng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)