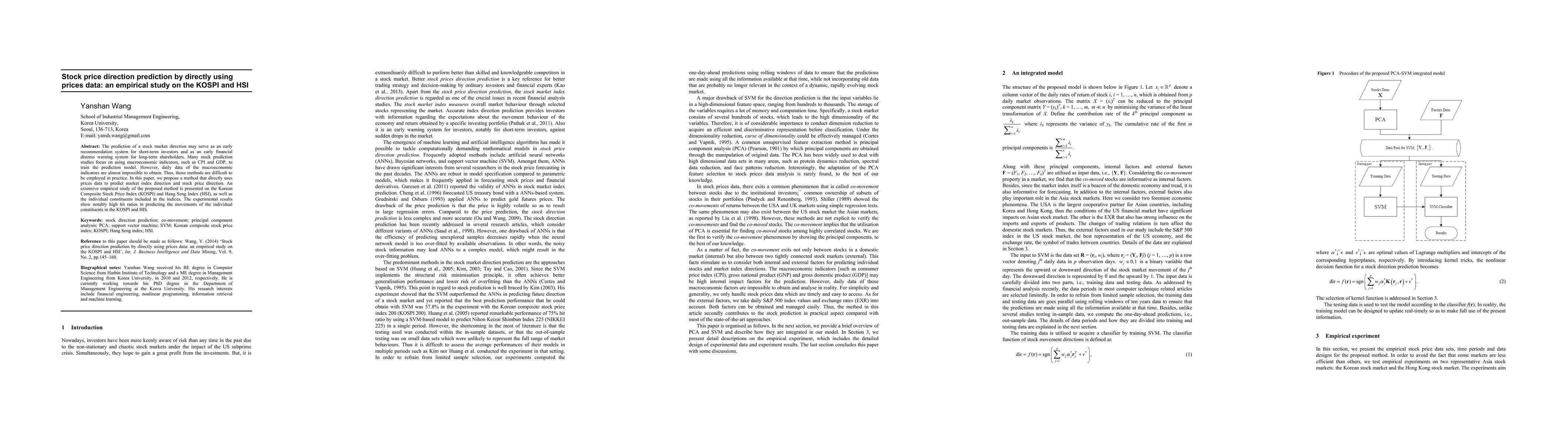

Summary

The prediction of a stock market direction may serve as an early recommendation system for short-term investors and as an early financial distress warning system for long-term shareholders. Many stock prediction studies focus on using macroeconomic indicators, such as CPI and GDP, to train the prediction model. However, daily data of the macroeconomic indicators are almost impossible to obtain. Thus, those methods are difficult to be employed in practice. In this paper, we propose a method that directly uses prices data to predict market index direction and stock price direction. An extensive empirical study of the proposed method is presented on the Korean Composite Stock Price Index (KOSPI) and Hang Seng Index (HSI), as well as the individual constituents included in the indices. The experimental results show notably high hit ratios in predicting the movements of the individual constituents in the KOSPI and HIS.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Predictability of Stock Price: Empirical Study onTick Data in Chinese Stock Market

Tian Lan, Xingyu Xu, Sihai Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)