Authors

Summary

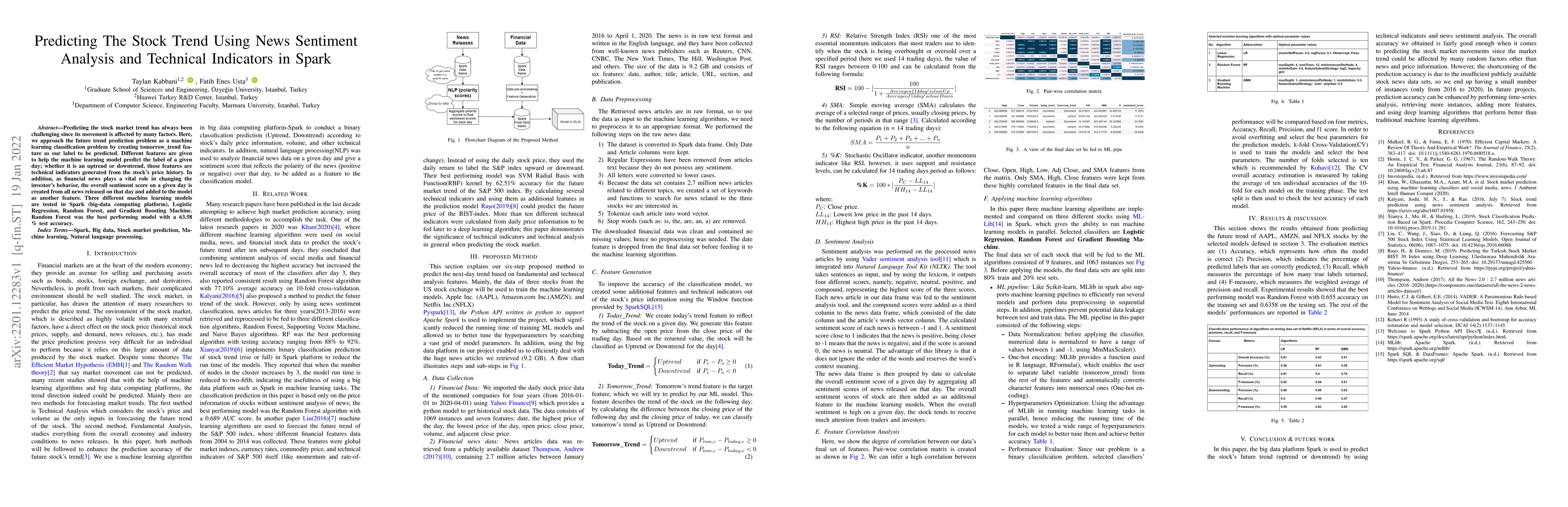

Predicting the stock market trend has always been challenging since its movement is affected by many factors. Here, we approach the future trend prediction problem as a machine learning classification problem by creating tomorrow_trend feature as our label to be predicted. Different features are given to help the machine learning model predict the label of a given day; whether it is an uptrend or downtrend, those features are technical indicators generated from the stock's price history. In addition, as financial news plays a vital role in changing the investor's behavior, the overall sentiment score on a given day is created from all news released on that day and added to the model as another feature. Three different machine learning models are tested in Spark (big-data computing platform), Logistic Regression, Random Forest, and Gradient Boosting Machine. Random Forest was the best performing model with a 63.58% test accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSupport for Stock Trend Prediction Using Transformers and Sentiment Analysis

Ye Qiao, Nader Bagherzadeh, Harsimrat Kaeley

Predicting Stock Prices with FinBERT-LSTM: Integrating News Sentiment Analysis

Yihao Zhong, Zhuoyue Wang, Wenjun Gu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)