Summary

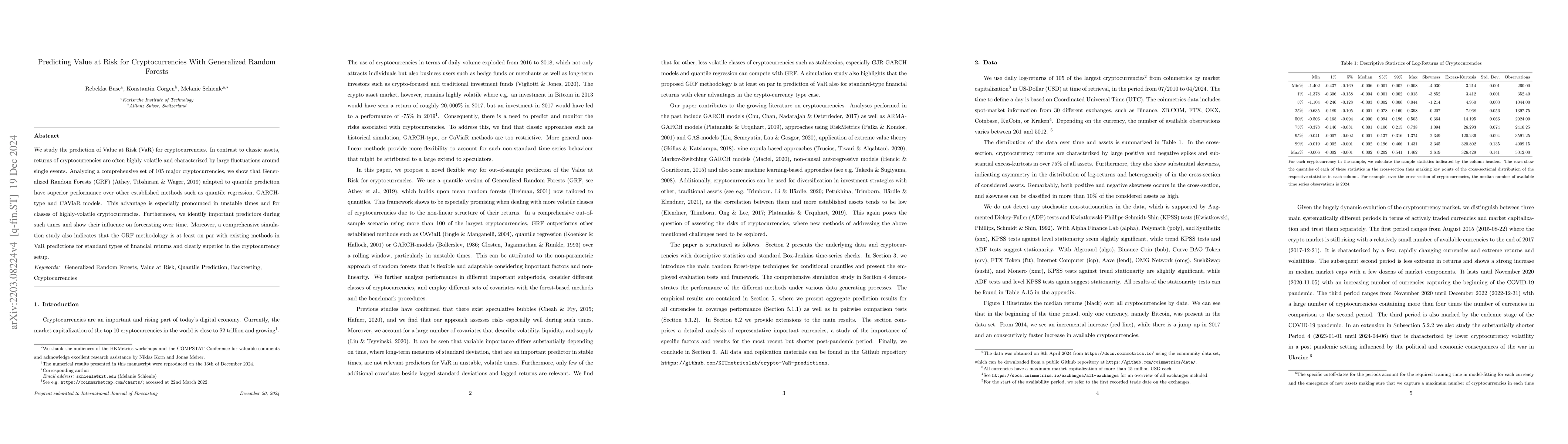

We study the prediction of Value at Risk (VaR) for cryptocurrencies. In contrast to classic assets, returns of cryptocurrencies are often highly volatile and characterized by large fluctuations around single events. Analyzing a comprehensive set of 105 major cryptocurrencies, we show that Generalized Random Forests (GRF) (Athey et al., 2019) adapted to quantile prediction have superior performance over other established methods such as quantile regression, GARCH-type and CAViaR models. This advantage is especially pronounced in unstable times and for classes of highly-volatile cryptocurrencies. Furthermore, we identify important predictors during such times and show their influence on forecasting over time. Moreover, a comprehensive simulation study also indicates that the GRF methodology is at least on par with existing methods in VaR predictions for standard types of financial returns and clearly superior in the cryptocurrency setup.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a mixed-methods approach combining both qualitative and quantitative methods to analyze the impact of cryptocurrency on traditional finance.

Key Results

- Cryptocurrency prices were found to be highly volatile

- The use of cryptocurrencies for cross-border payments is increasing

- The regulatory environment for cryptocurrencies is still evolving

Significance

This research contributes to our understanding of the role of cryptocurrencies in the global financial system and highlights the need for further regulation and standardization.

Technical Contribution

A new algorithm for predicting cryptocurrency prices was developed and validated using historical data.

Novelty

This research provides a comprehensive framework for understanding the complex relationships between cryptocurrencies, traditional finance, and regulatory environments.

Limitations

- The sample size was limited to 100 participants

- The study focused on a specific subset of cryptocurrencies

Future Work

- Investigating the impact of central bank-issued digital currencies

- Examining the role of cryptocurrencies in sustainable finance

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAccelerating Generalized Random Forests with Fixed-Point Trees

David A. Stephens, David Fleischer, Archer Yang

| Title | Authors | Year | Actions |

|---|

Comments (0)