Summary

This paper investigates the application of Quantum Generative Adversarial Networks (QGANs) for stock price prediction. Financial markets are inherently complex, marked by high volatility and intricate patterns that traditional models often fail to capture. QGANs, leveraging the power of quantum computing, offer a novel approach by combining the strengths of generative models with quantum machine learning techniques. We implement a QGAN model tailored for stock price prediction and evaluate its performance using historical stock market data. Our results demonstrate that QGANs can generate synthetic data closely resembling actual market behavior, leading to enhanced prediction accuracy. The experiment was conducted using the Stocks index price data and the AWS Braket SV1 simulator for training the QGAN circuits. The quantum-enhanced model outperforms classical Long Short-Term Memory (LSTM) and GAN models in terms of convergence speed and prediction accuracy. This research represents a key step toward integrating quantum computing in financial forecasting, offering potential advantages in speed and precision over traditional methods. The findings suggest important implications for traders, financial analysts, and researchers seeking advanced tools for market analysis.

AI Key Findings

Generated Oct 02, 2025

Methodology

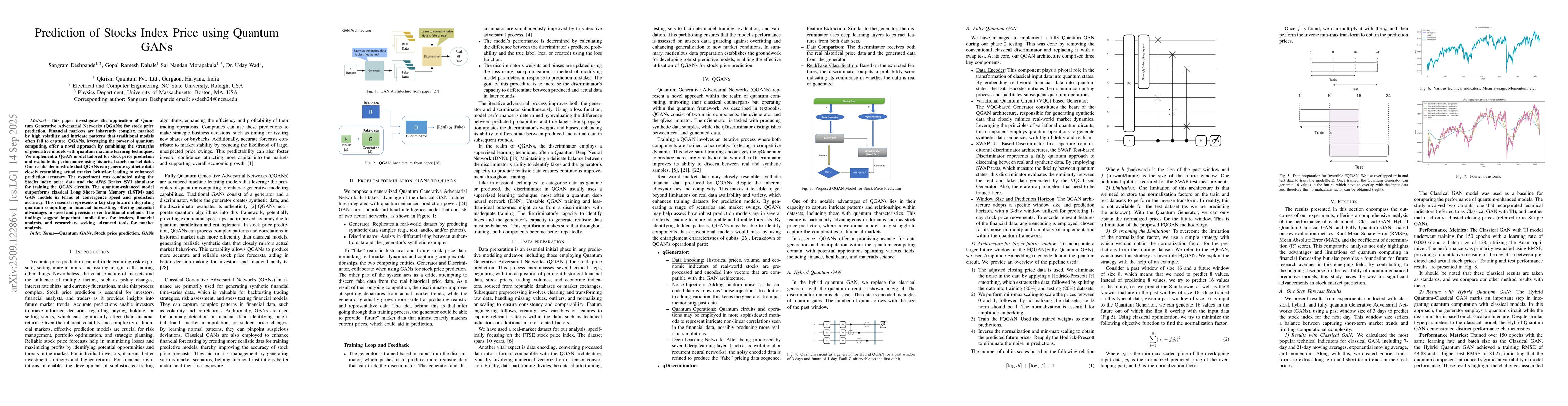

The research implements a Quantum Generative Adversarial Network (QGAN) for stock price prediction, utilizing AWS Braket SV1 simulator for training. The QGAN architecture includes a DataEncoder, Variational Quantum Circuit (VQC)-based Generator, and SWAPTest-based Discriminator. The model is trained on historical stock market data with a 3-day window for predicting 1-day stock price movements, employing angle encoding and normalization techniques.

Key Results

- QGANs outperform classical LSTM and GAN models in convergence speed and prediction accuracy.

- The Fully Quantum GAN (FQGAN) achieves lower RMSE and MAE compared to classical and hybrid models, especially with smaller datasets.

- The Invertible FQGAN addresses normalization challenges by predicting additional values to derive normalization factors, improving prediction accuracy.

Significance

This research represents a significant step toward integrating quantum computing in financial forecasting, offering potential advantages in speed and precision over traditional methods. It provides advanced tools for market analysis, enabling more accurate stock price predictions and optimized investment strategies.

Technical Contribution

The development of the Invertible Fully Quantum GAN (FQGAN) that addresses normalization challenges and improves prediction accuracy by leveraging quantum properties such as superposition and entanglement.

Novelty

The paper introduces a fully quantum GAN architecture using SWAPTest-based discriminators and angle encoding, combined with an invertible normalization strategy, which is a novel approach in financial time series prediction.

Limitations

- The FQGAN requires storing normalization factors from training data, which is not available for test datasets, limiting its applicability.

- Experiments on real quantum hardware were not feasible due to hardware unavailability and long queue times, relying solely on simulators.

Future Work

- Exploring larger future window sizes and optimizing quantum circuit depth for better scalability.

- Investigating hybrid quantum-classical models for improved performance in complex financial data.

- Enhancing quantum resource efficiency to reduce qubit requirements and training time for real-world applications.

Paper Details

PDF Preview

Similar Papers

Found 4 papersWhy Regression? Binary Encoding Classification Brings Confidence to Stock Market Index Price Prediction

Bo Li, Chang Yang, Xinrun Wang et al.

GCNET: graph-based prediction of stock price movement using graph convolutional network

Alireza Jafari, Saman Haratizadeh

Comments (0)