Authors

Summary

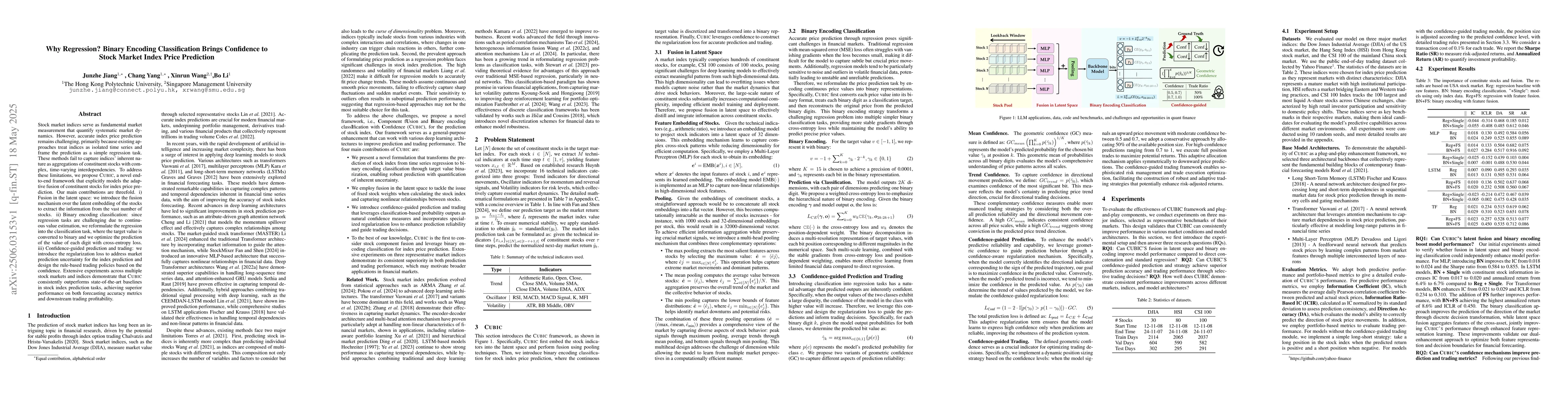

Stock market indices serve as fundamental market measurement that quantify systematic market dynamics. However, accurate index price prediction remains challenging, primarily because existing approaches treat indices as isolated time series and frame the prediction as a simple regression task. These methods fail to capture indices' inherent nature as aggregations of constituent stocks with complex, time-varying interdependencies. To address these limitations, we propose Cubic, a novel end-to-end framework that explicitly models the adaptive fusion of constituent stocks for index price prediction. Our main contributions are threefold. i) Fusion in the latent space: we introduce the fusion mechanism over the latent embedding of the stocks to extract the information from the vast number of stocks. ii) Binary encoding classification: since regression tasks are challenging due to continuous value estimation, we reformulate the regression into the classification task, where the target value is converted to binary and we optimize the prediction of the value of each digit with cross-entropy loss. iii) Confidence-guided prediction and trading: we introduce the regularization loss to address market prediction uncertainty for the index prediction and design the rule-based trading policies based on the confidence. Extensive experiments across multiple stock markets and indices demonstrate that Cubic consistently outperforms state-of-the-art baselines in stock index prediction tasks, achieving superior performance on both forecasting accuracy metrics and downstream trading profitability.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research proposes Cubic, an end-to-end framework that models the adaptive fusion of constituent stocks for index price prediction, utilizing fusion in latent space, binary encoding classification, and confidence-guided prediction.

Key Results

- Cubic outperforms state-of-the-art baselines in stock index prediction tasks across multiple markets.

- The binary encoding classification approach improves prediction accuracy by converting target values to binary and optimizing digit value predictions with cross-entropy loss.

Significance

This research is important as it addresses the limitations of existing regression-based methods for stock market index prediction, offering a novel classification-based approach that enhances forecasting accuracy and trading profitability.

Technical Contribution

The introduction of Cubic, a framework that fuses constituent stock information in latent space and reformulates index price prediction as a classification problem, is the main technical contribution.

Novelty

Cubic's novelty lies in its approach to modeling stock market indices as aggregations of constituent stocks with complex interdependencies, using binary encoding classification and confidence-guided prediction, which distinguishes it from traditional regression-based methods.

Limitations

- The paper does not discuss potential limitations in data availability or quality for various stock markets.

- Generalizability of the method to less-studied or emerging markets remains unexplored.

Future Work

- Investigate the applicability of Cubic to other financial assets and markets beyond established indices.

- Explore the impact of incorporating additional financial indicators or alternative encoding methods on prediction performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

Feature selection and regression methods for stock price prediction using technical indicators

Fatemeh Moodi, Amir Jahangard-Rafsanjani, Sajad Zarifzadeh

The Potential of Quantum Techniques for Stock Price Prediction

Aswath Babu H, Naman S, Gaurang B et al.

No citations found for this paper.

Comments (0)