Authors

Summary

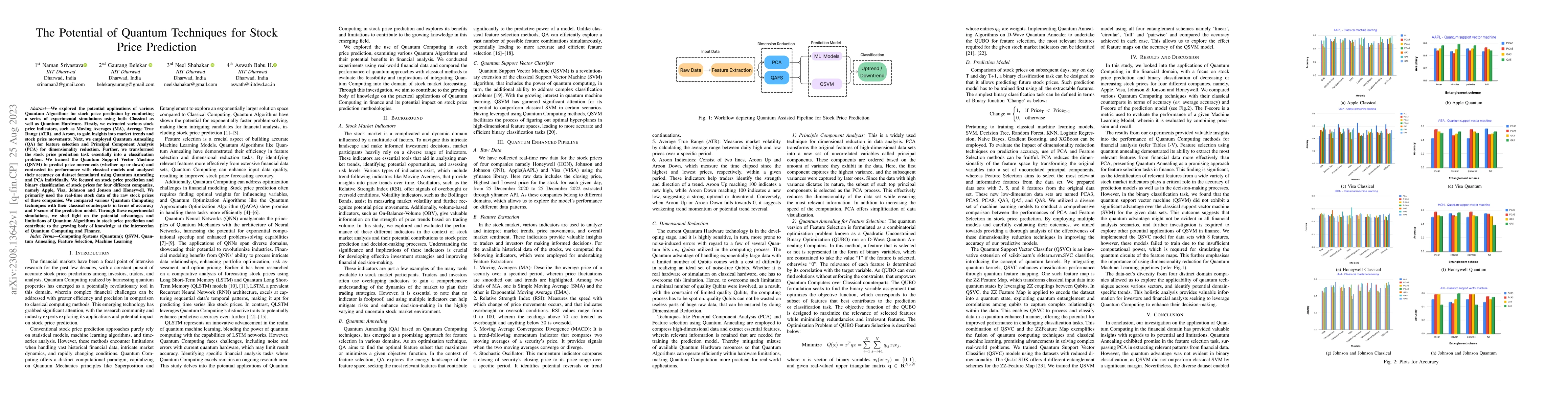

We explored the potential applications of various Quantum Algorithms for stock price prediction by conducting a series of experimental simulations using both Classical as well as Quantum Hardware. Firstly, we extracted various stock price indicators, such as Moving Averages (MA), Average True Range (ATR), and Aroon, to gain insights into market trends and stock price movements. Next, we employed Quantum Annealing (QA) for feature selection and Principal Component Analysis (PCA) for dimensionality reduction. Further, we transformed the stock price prediction task essentially into a classification problem. We trained the Quantum Support Vector Machine (QSVM) to predict price movements (whether up or down) contrasted their performance with classical models and analyzed their accuracy on a dataset formulated using Quantum Annealing and PCA individually. We focused on the stock price prediction and binary classification of stock prices for four different companies, namely Apple, Visa, Johnson and Jonson, and Honeywell. We primarily used the real-time stock data of the raw stock prices of these companies. We compared various Quantum Computing techniques with their classical counterparts in terms of accuracy and F-score of the prediction model. Through these experimental simulations, we shed light on the potential advantages and limitations of Quantum Algorithms in stock price prediction and contribute to the growing body of knowledge at the intersection of Quantum Computing and Finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContextual Quantum Neural Networks for Stock Price Prediction

Hannes Leipold, Bibhas Adhikari, Sharan Mourya

Multimodal Stock Price Prediction

Furkan Karadaş, Bahaeddin Eravcı, Ahmet Murat Özbayoğlu

| Title | Authors | Year | Actions |

|---|

Comments (0)