Summary

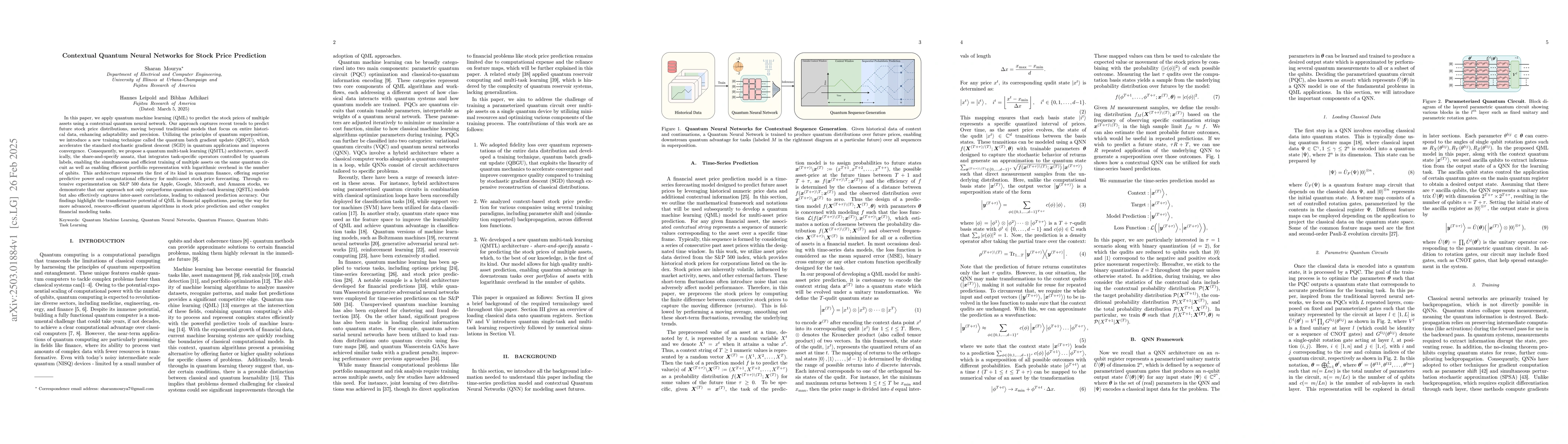

In this paper, we apply quantum machine learning (QML) to predict the stock prices of multiple assets using a contextual quantum neural network. Our approach captures recent trends to predict future stock price distributions, moving beyond traditional models that focus on entire historical data, enhancing adaptability and precision. Utilizing the principles of quantum superposition, we introduce a new training technique called the quantum batch gradient update (QBGU), which accelerates the standard stochastic gradient descent (SGD) in quantum applications and improves convergence. Consequently, we propose a quantum multi-task learning (QMTL) architecture, specifically, the share-and-specify ansatz, that integrates task-specific operators controlled by quantum labels, enabling the simultaneous and efficient training of multiple assets on the same quantum circuit as well as enabling efficient portfolio representation with logarithmic overhead in the number of qubits. This architecture represents the first of its kind in quantum finance, offering superior predictive power and computational efficiency for multi-asset stock price forecasting. Through extensive experimentation on S\&P 500 data for Apple, Google, Microsoft, and Amazon stocks, we demonstrate that our approach not only outperforms quantum single-task learning (QSTL) models but also effectively captures inter-asset correlations, leading to enhanced prediction accuracy. Our findings highlight the transformative potential of QML in financial applications, paving the way for more advanced, resource-efficient quantum algorithms in stock price prediction and other complex financial modeling tasks.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper applies quantum machine learning (QML) using a contextual quantum neural network to predict stock prices, introducing a quantum batch gradient update (QBGU) technique for accelerated convergence and a quantum multi-task learning (QMTL) architecture for efficient multi-asset training.

Key Results

- The proposed QBGU method improves convergence speed in quantum applications compared to standard stochastic gradient descent (SGD).

- The QMTL architecture, specifically the share-and-specify ansatz, enables simultaneous and efficient training of multiple assets on a single quantum circuit with logarithmic overhead in the number of qubits.

- Experiments on S&P 500 data for Apple, Google, Microsoft, and Amazon stocks demonstrate that the QMTL approach outperforms quantum single-task learning (QSTL) models and effectively captures inter-asset correlations, enhancing prediction accuracy.

- The findings highlight the potential of QML in financial applications, suggesting more advanced and resource-efficient quantum algorithms for stock price prediction and complex financial modeling tasks.

Significance

This research is significant as it leverages quantum computing to improve stock price prediction accuracy and efficiency, offering a novel approach that surpasses traditional models by focusing on recent trends and capturing inter-asset correlations.

Technical Contribution

The paper introduces a novel quantum batch gradient update (QBGU) method and a quantum multi-task learning (QMTL) architecture, specifically the share-and-specify ansatz, for efficient and accurate stock price prediction using quantum neural networks.

Novelty

The work stands out by integrating contextual information, employing quantum batch gradient updates, and utilizing a quantum multi-task learning architecture to efficiently train and predict stock prices for multiple assets simultaneously, thereby offering superior predictive power and computational efficiency.

Limitations

- The study is limited to stock price prediction and does not explore other financial modeling tasks.

- The effectiveness of the proposed methodology relies on the availability of quantum hardware capable of supporting the required circuit depth and qubit count.

Future Work

- Investigate the applicability of the proposed QMTL architecture to other financial time-series data, such as commodity prices or exchange rates.

- Explore the scalability of the approach to larger datasets and more assets, potentially requiring advancements in quantum hardware and error correction techniques.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Potential of Quantum Techniques for Stock Price Prediction

Aswath Babu H, Naman S, Gaurang B et al.

No citations found for this paper.

Comments (0)