Authors

Summary

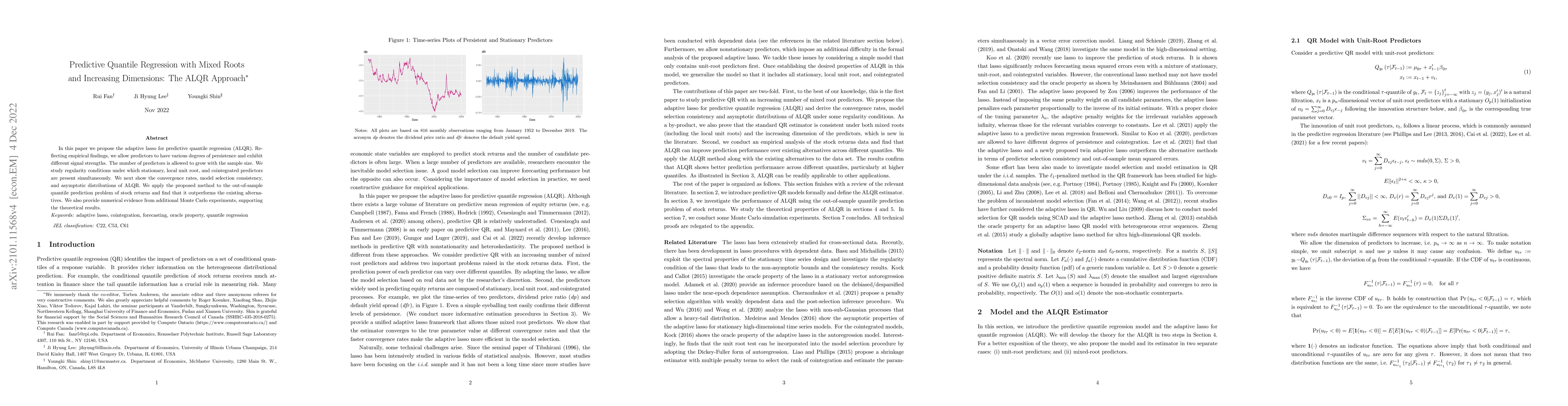

In this paper we propose the adaptive lasso for predictive quantile regression (ALQR). Reflecting empirical findings, we allow predictors to have various degrees of persistence and exhibit different signal strengths. The number of predictors is allowed to grow with the sample size. We study regularity conditions under which stationary, local unit root, and cointegrated predictors are present simultaneously. We next show the convergence rates, model selection consistency, and asymptotic distributions of ALQR. We apply the proposed method to the out-of-sample quantile prediction problem of stock returns and find that it outperforms the existing alternatives. We also provide numerical evidence from additional Monte Carlo experiments, supporting the theoretical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimating Conditional Value-at-Risk with Nonstationary Quantile Predictive Regression Models

Christis Katsouris

Predictive Quantile Regression with High-Dimensional Predictors: The Variable Screening Approach

Ji Hyung Lee, Hongqi Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)