Summary

Decision maker's preferences are often captured by some choice functions which are used to rank prospects. In this paper, we consider ambiguity in choice functions over a multi-attribute prospect space. Our main result is a robust preference model where the optimal decision is based on the worst-case choice function from an ambiguity set constructed through preference elicitation with pairwise comparisons of prospects. Differing from existing works in the area, our focus is on quasi-concave choice functions rather than concave functions and this enables us to cover a wide range of utility/risk preference problems including multi-attribute expected utility and $S$-shaped aspirational risk preferences. The robust choice function is increasing and quasi-concave but not necessarily translation invariant, a key property of monetary risk measures. We propose two approaches based respectively on the support functions and level functions of quasi-concave functions to develop tractable formulations of the maximin preference robust optimization model. The former gives rise to a mixed integer linear programming problem whereas the latter is equivalent to solving a sequence of convex risk minimization problems. To assess the effectiveness of the proposed robust preference optimization model and numerical schemes, we apply them to a security budget allocation problem and report some preliminary results from experiments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

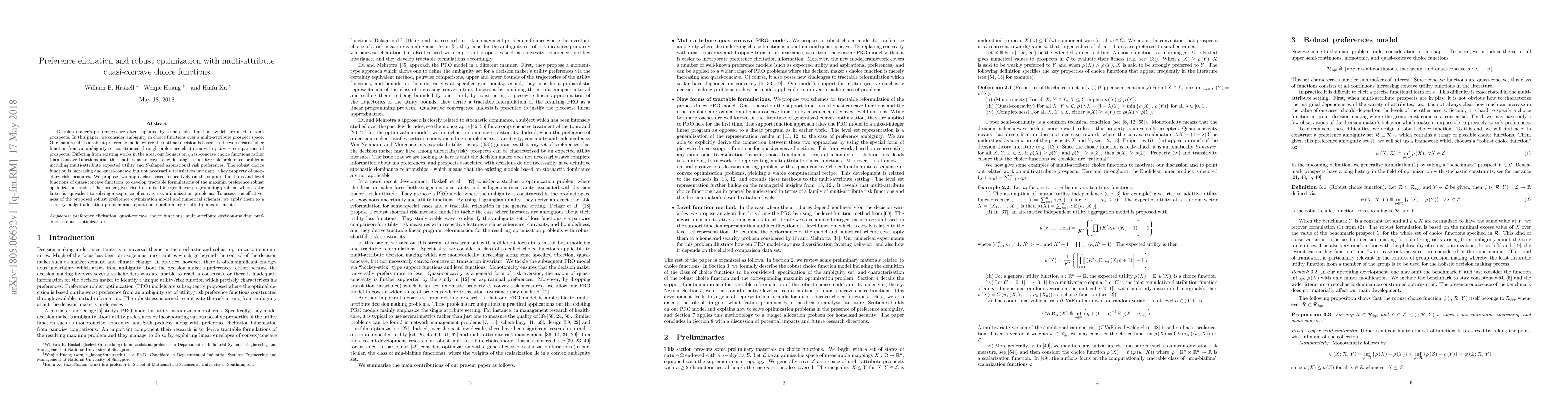

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)