Authors

Summary

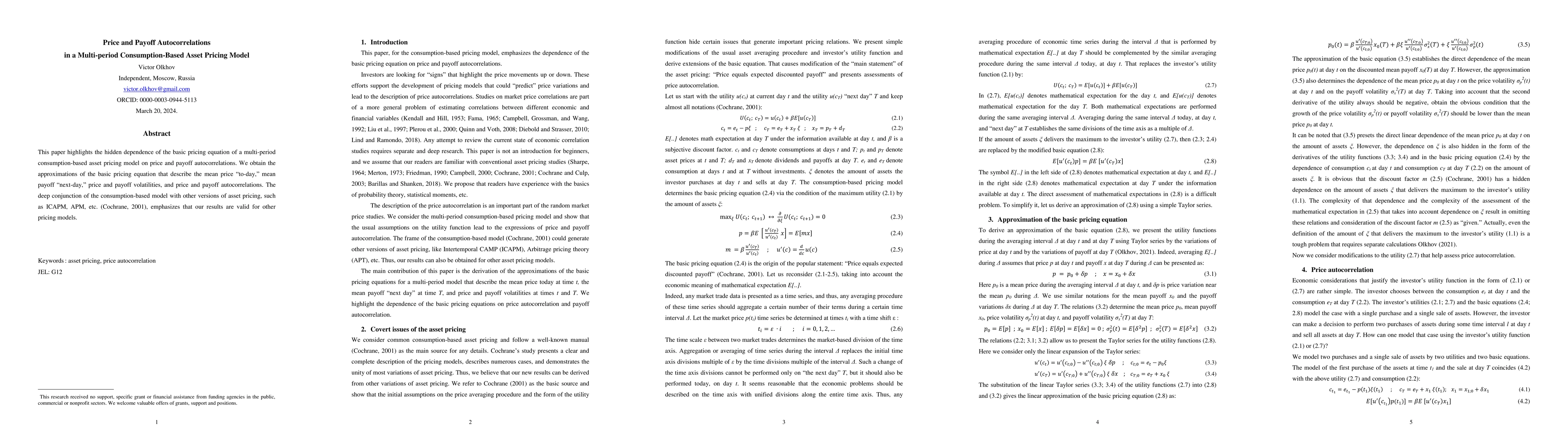

This paper highlights the hidden dependence of the basic pricing equation of a multi-period consumption-based asset pricing model on price and payoff autocorrelations. We obtain the approximations of the basic pricing equation that describe the mean price "to-day," mean payoff "next-day," price and payoff volatilities, and price and payoff autocorrelations. The deep conjunction of the consumption-based model with other versions of asset pricing, such as ICAPM, APM, etc. (Cochrane, 2001), emphasizes that our results are valid for other pricing models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReference-dependent asset pricing with a stochastic consumption-dividend ratio

Yuting Yang, Xuedong He, Luca De Gennaro Aquino et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)