Authors

Summary

We consider the path-dependent volatility (PDV) model of Guyon and Lekeufack (2023), where the instantaneous volatility is a linear combination of a weighted sum of past returns and the square root of a weighted sum of past squared returns. We discuss the influence of an additional parameter that unlocks enough volatility on the upside to reproduce the implied volatility smiles of S&P 500 and VIX options. This PDV model, motivated by empirical studies, comes with computational challenges, especially in relation to VIX options pricing and calibration. We propose an accurate neural network approximation of the VIX which leverages on the Markovianity of the 4-factor version of the model. The VIX is learned as a function of the Markovian factors and the model parameters. We use this approximation to tackle the joint calibration of S&P 500 and VIX options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

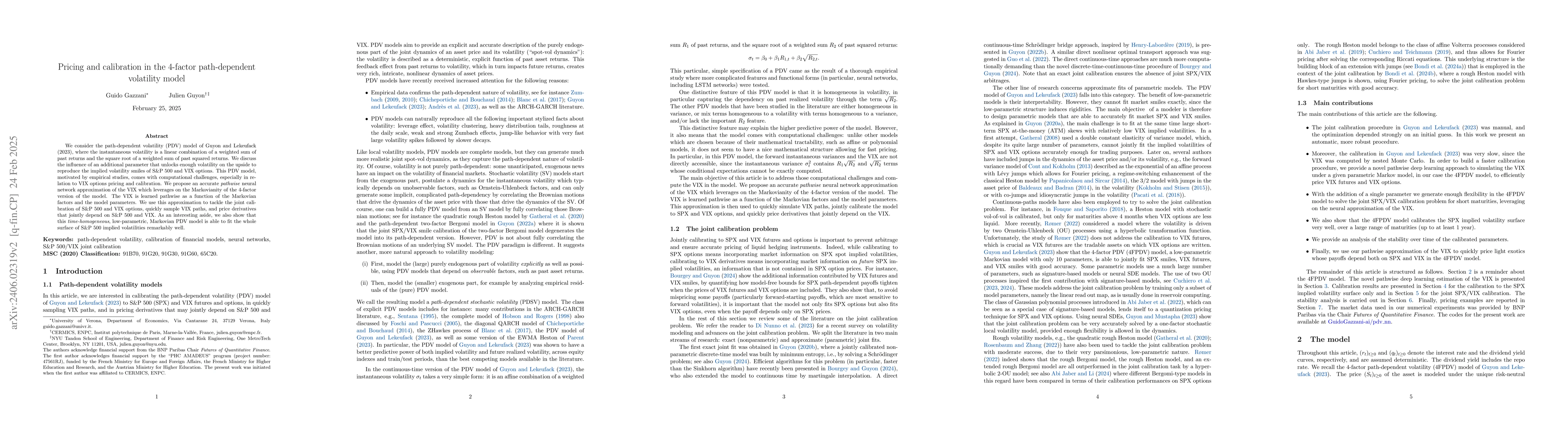

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersJoint deep calibration of the 4-factor PDV model

Fabio Baschetti, Giacomo Bormetti, Pietro Rossi

| Title | Authors | Year | Actions |

|---|

Comments (0)