Summary

We analyze multiline pricing and capital allocation in equilibrium no-arbitrage markets. Existing theories often assume a perfect complete market, but when pricing is linear, there is no diversification benefit from risk pooling and therefore no role for insurance companies. Instead of a perfect market, we assume a non-additive distortion pricing functional and the principle of equal priority of payments in default. Under these assumptions, we derive a canonical allocation of premium and margin, with properties that merit the name the natural allocation. The natural allocation gives non-negative margins to all independent lines for default-free insurance but can exhibit negative margins for low-risk lines under limited liability. We introduce novel conditional expectation measures of relative risk within a portfolio and use them to derive simple, intuitively appealing expressions for risk margins and capital allocations. We give a unique capital allocation consistent with our law invariant pricing functional. Such allocations produce returns that vary by line, in contrast to many other approaches. Our model provides a bridge between the theoretical perspective that there should be no compensation for bearing diversifiable risk and the empirical observation that more risky lines fetch higher margins relative to subjective expected values.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

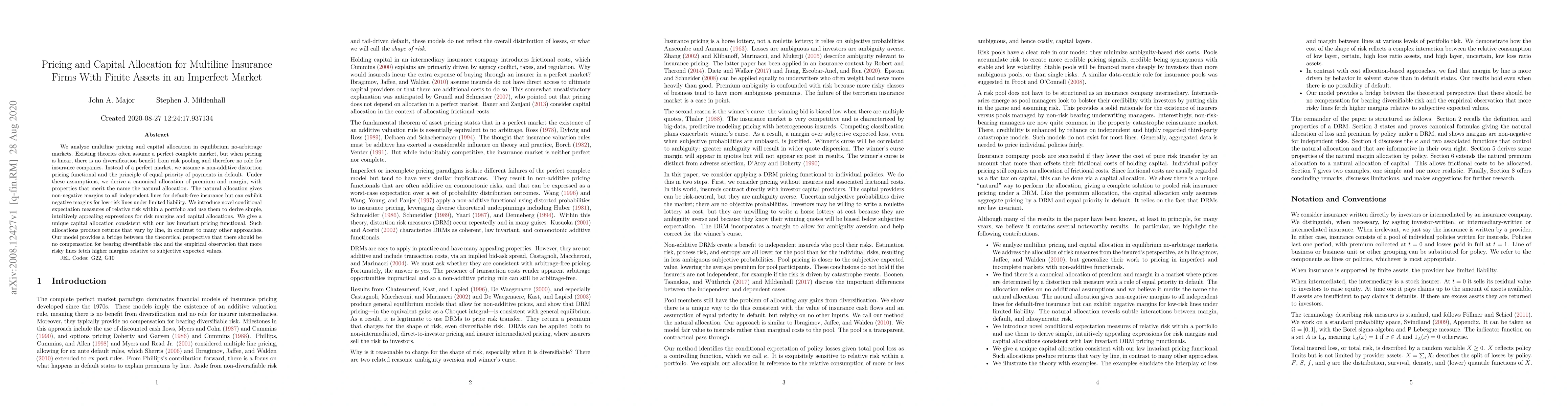

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)