Authors

Summary

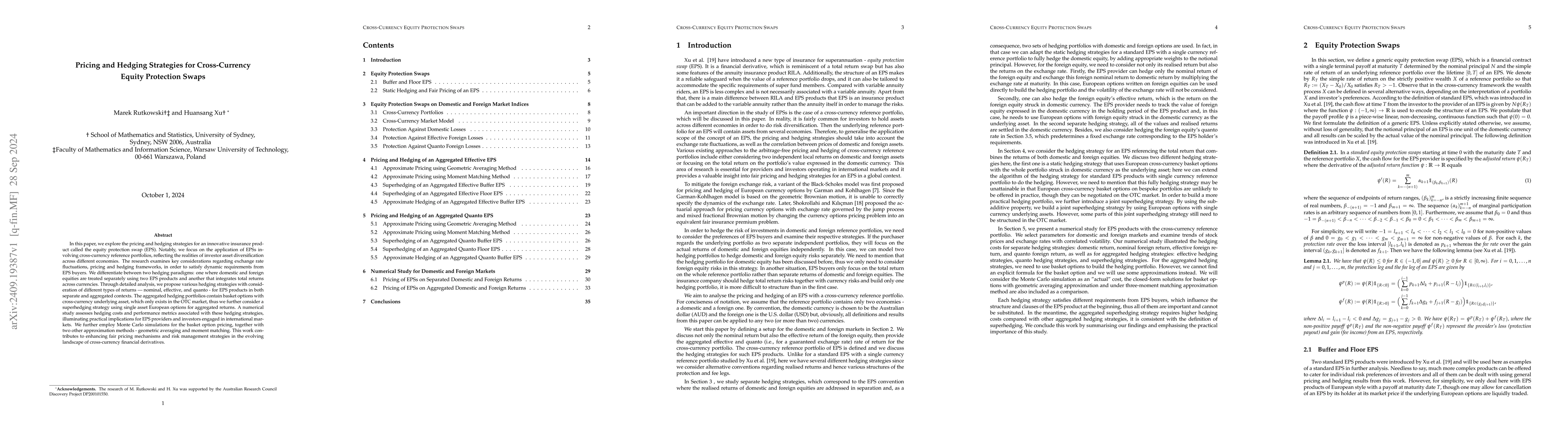

In this paper, we explore the pricing and hedging strategies for an innovative insurance product called the equity protection swap(EPS). Notably, we focus on the application of EPSs involving cross-currency reference portfolios, reflecting the realities of investor asset diversification across different economies. The research examines key considerations regarding exchange rate fluctuations, pricing and hedging frameworks, in order to satisfy dynamic requirements from EPS buyers. We differentiate between two hedging paradigms: one where domestic and foreign equities are treated separately using two EPS products and another that integrates total returns across currencies. Through detailed analysis, we propose various hedging strategies with consideration of different types of returns - nominal, effective, and quanto - for EPS products in both separate and aggregated contexts. The aggregated hedging portfolios contain basket options with cross-currency underlying asset, which only exists in the OTC market, thus we further consider a superhedging strategy using single asset European options for aggregated returns. A numerical study assesses hedging costs and performance metrics associated with these hedging strategies, illuminating practical implications for EPS providers and investors engaged in international markets. We further employ Monte Carlo simulations for the basket option pricing, together with two other approximation methods - geometric averaging and moment matching. This work contributes to enhancing fair pricing mechanisms and risk management strategies in the evolving landscape of cross-currency financial derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)