Summary

In this paper we provide a valuation formula for different classes of actuarial and financial contracts which depend on a general loss process, by using the Malliavin calculus. In analogy with the celebrated Black-Scholes formula, we aim at expressing the expected cash flow in terms of a building block. The former is related to the loss process which is a cumulated sum indexed by a doubly stochastic Poisson process of claims allowed to be dependent on the intensity and the jump times of the counting process. For example, in the context of Stop-Loss contracts the building block is given by the distribution function of the terminal cumulated loss, taken at the Value at Risk when computing the Expected Shortfall risk measure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

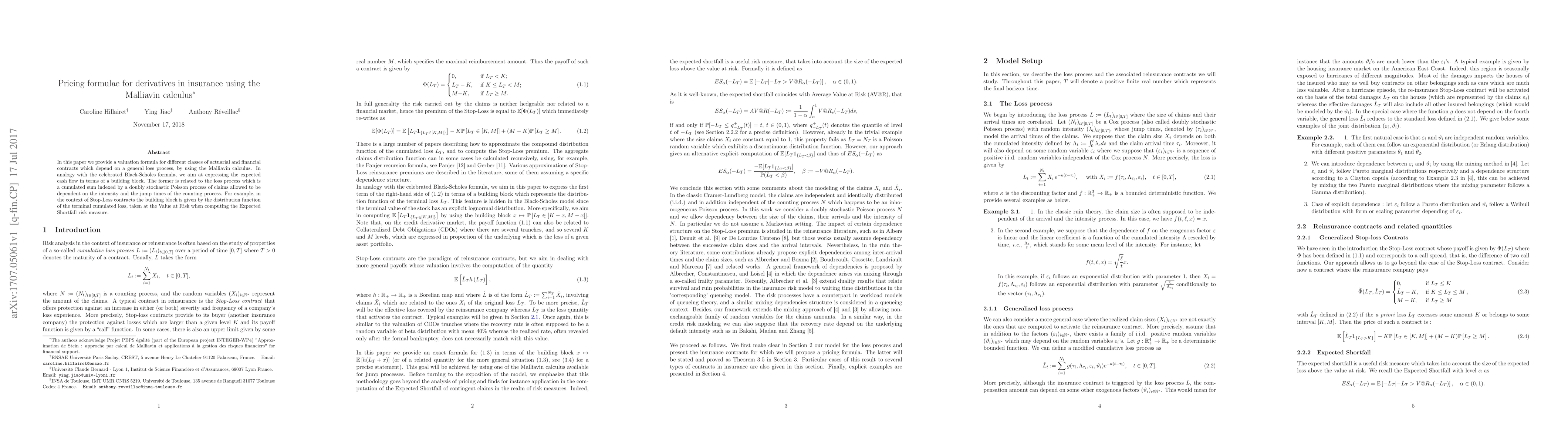

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)