Summary

Spot option prices, forwards and options on forwards relevant for the commodity markets are computed when the underlying process S is modelled as an exponential of a process {\xi} with memory as e.g. a L\'evy semi-stationary process. Moreover a risk premium \r{ho} representing storage costs, illiquidity, convenience yield or insurance costs is explicitly modelled as an Ornstein-Uhlenbeck type of dynamics with a mean level that depends on the same memory term as the commodity. Also the interest rate is assumed to be stochastic. To show the existence of an equivalent pricing measure Q for S we relate the stochastic differential equation for {\xi} to the generalised Langevin equation. When the interest rate is deterministic the process ({\xi}; \r{ho}) has an affine structure under the pricing measure Q and an explicit expression for the option price is derived in terms of the Fourier transform of the payoff function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

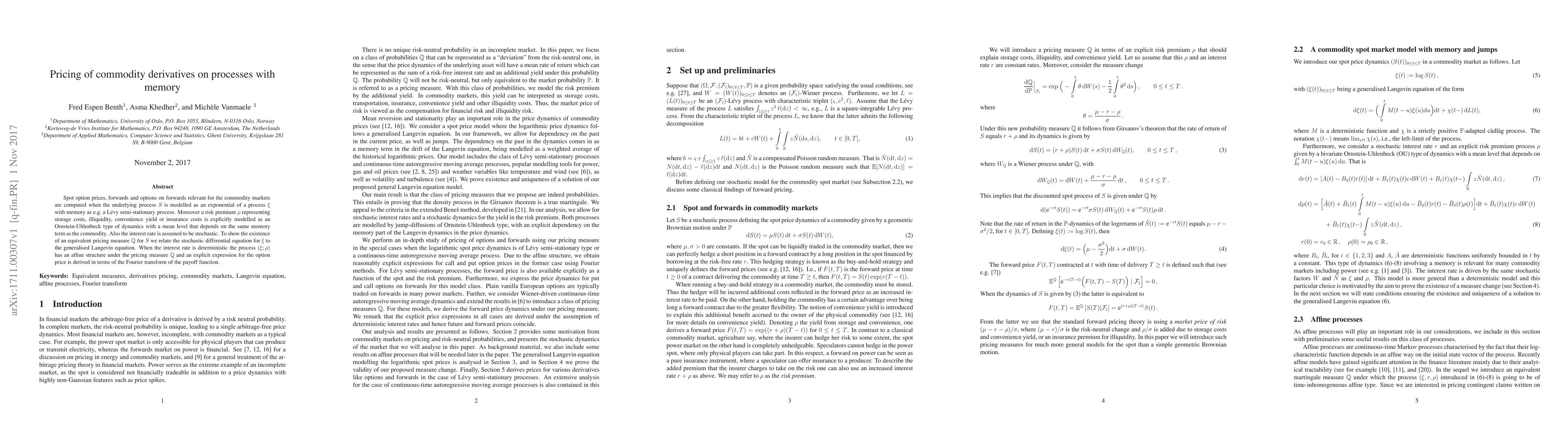

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing commodity index options

Carlos Vázquez, Andrea Pallavicini, Alberto Manzano et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)