Authors

Summary

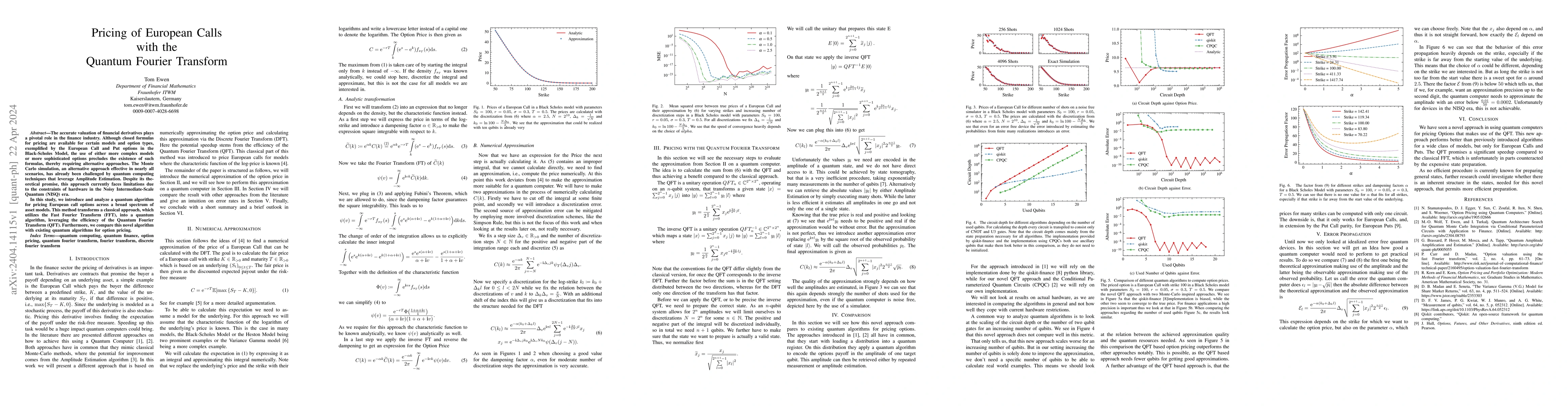

The accurate valuation of financial derivatives plays a pivotal role in the finance industry. Although closed formulas for pricing are available for certain models and option types, exemplified by the European Call and Put options in the Black-Scholes Model, the use of either more complex models or more sophisticated options precludes the existence of such formulas, thereby requiring alternative approaches. The Monte Carlo simulation, an alternative approach effective in nearly all scenarios, has already been challenged by quantum computing techniques that leverage Amplitude Estimation. Despite its theoretical promise, this approach currently faces limitations due to the constraints of hardware in the Noisy Intermediate-Scale Quantum (NISQ) era. In this study, we introduce and analyze a quantum algorithm for pricing European call options across a broad spectrum of asset models. This method transforms a classical approach, which utilizes the Fast Fourier Transform (FFT), into a quantum algorithm, leveraging the efficiency of the Quantum Fourier Transform (QFT). Furthermore, we compare this novel algorithm with existing quantum algorithms for option pricing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)