Summary

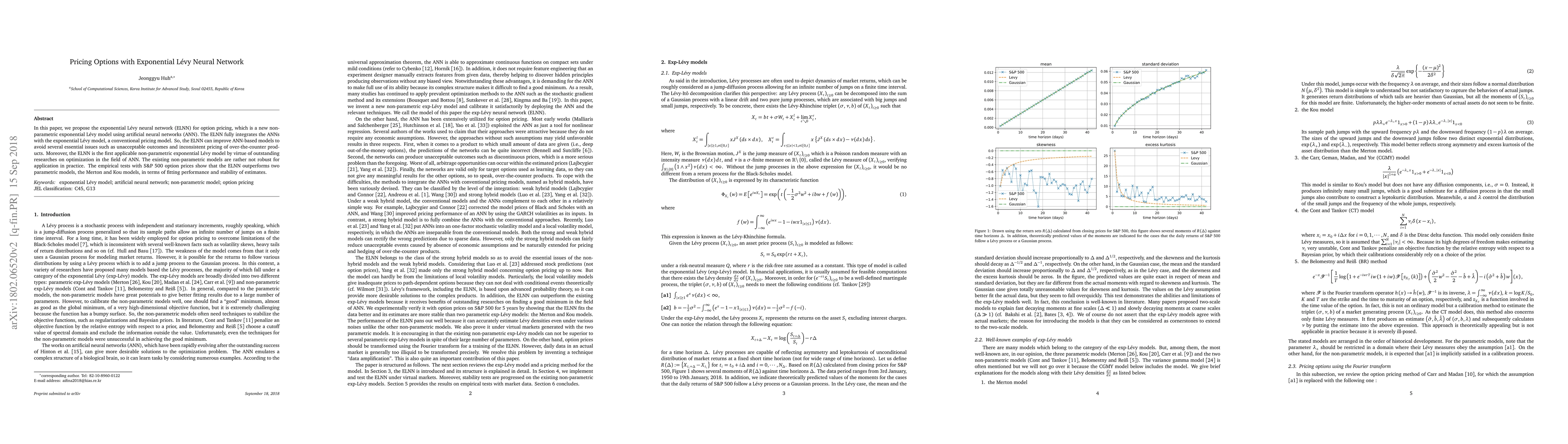

In this paper, we propose the exponential Levy neural network (ELNN) for option pricing, which is a new non-parametric exponential Levy model using artificial neural networks (ANN). The ELNN fully integrates the ANNs with the exponential Levy model, a conventional pricing model. So, the ELNN can improve ANN-based models to avoid several essential issues such as unacceptable outcomes and inconsistent pricing of over-the-counter products. Moreover, the ELNN is the first applicable non-parametric exponential Levy model by virtue of outstanding researches on optimization in the field of ANN. The existing non-parametric models are too vulnerable to be employed in practice. The empirical tests with S\&P 500 option prices show that the ELNN outperforms two parametric models, the Merton and Kou models, in terms of fitting performance and stability of estimates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutocallable Options Pricing with Integration-Based Exponential Amplitude Loading

Tamuz Danzig, Christian Mattia, Giacomo Ranieri et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)