Summary

The common way to optimize auction and pricing systems is to set aside a small fraction of the traffic to run experiments. This leads to the question: how can we learn the most with the smallest amount of data? For truthful auctions, this is the \emph{sample complexity} problem. For posted price auctions, we no longer have access to samples. Instead, the algorithm is allowed to choose a price $p_t$; then for a fresh sample $v_t \sim \mathcal{D}$ we learn the sign $s_t = sign(p_t - v_t) \in \{-1,+1\}$. How many pricing queries are needed to estimate a given parameter of the underlying distribution? We give tight upper and lower bounds on the number of pricing queries required to find an approximately optimal reserve price for general, regular and MHR distributions. Interestingly, for regular distributions, the pricing query and sample complexities match. But for general and MHR distributions, we show a strict separation between them. All known results on sample complexity for revenue optimization follow from a variant of using the optimal reserve price of the empirical distribution. In the pricing query complexity setting, we show that learning the entire distribution within an error of $\epsilon$ in Levy distance requires strictly more pricing queries than to estimate the reserve. Instead, our algorithm uses a new property we identify called \emph{relative flatness} to quickly zoom into the right region of the distribution to get the optimal pricing query complexity.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper analyzes the pricing query complexity for revenue maximization in auctions, contrasting sample complexity with pricing query complexity for truthful and posted price auctions.

Key Results

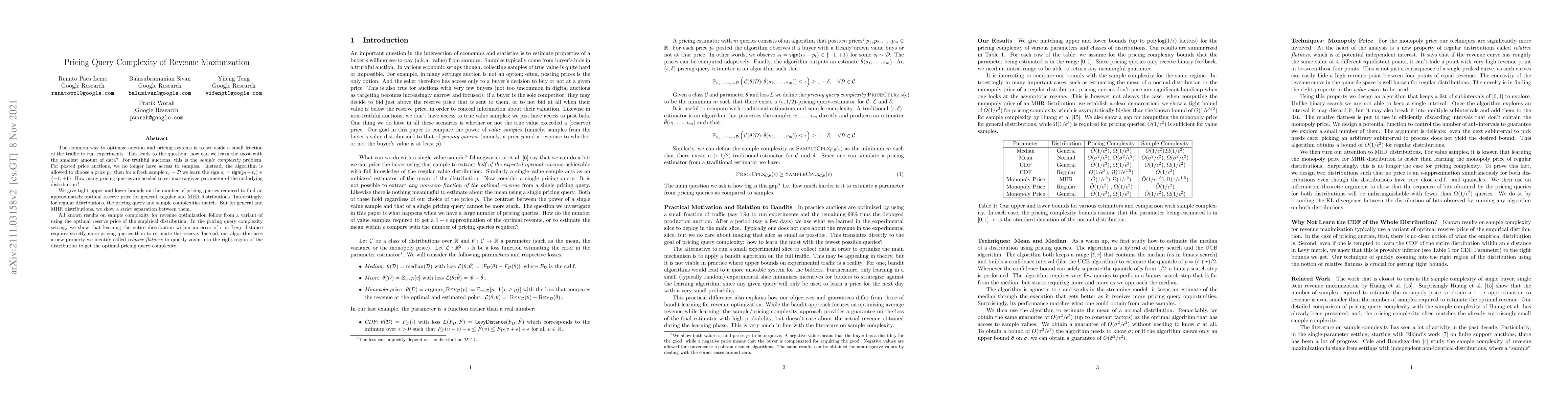

- Tight upper and lower bounds are provided for the number of pricing queries needed to estimate an approximately optimal reserve price for general, regular, and MHR distributions.

- For regular distributions, pricing query and sample complexities match, but for general and MHR distributions, a strict separation is shown.

- A new property called 'relative flatness' is identified to quickly zoom into the right region of the distribution for optimal pricing query complexity.

- Ω(1/ǫ2) pricing queries are shown to be necessary for distinguishing two MHR distributions with close cumulative density functions.

- Ω(1/ǫ2.5) pricing queries are required for learning a regular distribution within O(ǫ) Levy distance, highlighting a scenario with an asymptotic gap between pricing query complexity and sample complexity.

Significance

This research is significant as it provides insights into the efficiency of data usage in auction design, particularly in distinguishing between sample complexity and pricing query complexity, which is crucial for optimizing revenue in auction mechanisms.

Technical Contribution

The paper introduces the concept of 'relative flatness' and uses it to develop algorithms that efficiently estimate optimal reserve prices with fewer pricing queries, bridging the gap between sample complexity and pricing query complexity.

Novelty

The work distinguishes itself by identifying 'relative flatness' as a key property and demonstrating a strict separation between pricing query and sample complexities for certain distribution classes, offering new theoretical insights into auction mechanism design.

Limitations

- The study focuses on specific classes of distributions (regular, MHR, general) and does not explore the implications for broader classes of distributions.

- The results are theoretical and may not directly translate to practical improvements in auction design without further empirical validation.

Future Work

- Investigate the pricing query complexities for broader classes of distributions beyond regular, MHR, and general.

- Explore the practical implications of the theoretical findings in real-world auction design and implementation.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOnline Revenue Maximization for Server Pricing

Federico Fusco, Stefano Leonardi, Yishay Mansour et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)