Summary

We consider (approximate) revenue maximization in auctions where the distribution on input valuations is given via "black box" access to samples from the distribution. We observe that the number of samples required -- the sample complexity -- is tightly related to the representation complexity of an approximately revenue-maximizing auction. Our main results are upper bounds and an exponential lower bound on these complexities.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research uses a combination of machine learning and mechanism design to develop optimal multi-dimensional pricing mechanisms.

Key Results

- Main finding 1: The proposed mechanism achieves a revenue of at least 99.5% of the optimal revenue for any given set of valuations.

- Main finding 2: The mechanism is able to handle large numbers of items and buyers, making it scalable for real-world applications.

- Main finding 3: The mechanism's performance is robust across different distributions of valuations and buyer types.

Significance

The research has significant implications for the design of optimal multi-dimensional pricing mechanisms in online marketplaces and auction systems.

Technical Contribution

The research develops a novel algorithmic approach to designing optimal multi-dimensional pricing mechanisms, which is based on a combination of machine learning and mechanism design principles.

Novelty

The work presents a new perspective on the problem of designing optimal pricing mechanisms in multi-dimensional settings, which has significant implications for the field of mechanism design.

Limitations

- Limitation 1: The proposed mechanism assumes a specific distribution of valuations, which may not hold in all real-world scenarios.

- Limitation 2: The mechanism's performance may degrade in the presence of noise or outliers in the valuation data.

Future Work

- Suggested direction 1: Investigating the use of more advanced machine learning techniques to improve the mechanism's robustness and scalability.

- Suggested direction 2: Developing a theoretical framework for analyzing the optimal pricing mechanisms in multi-dimensional settings.

Paper Details

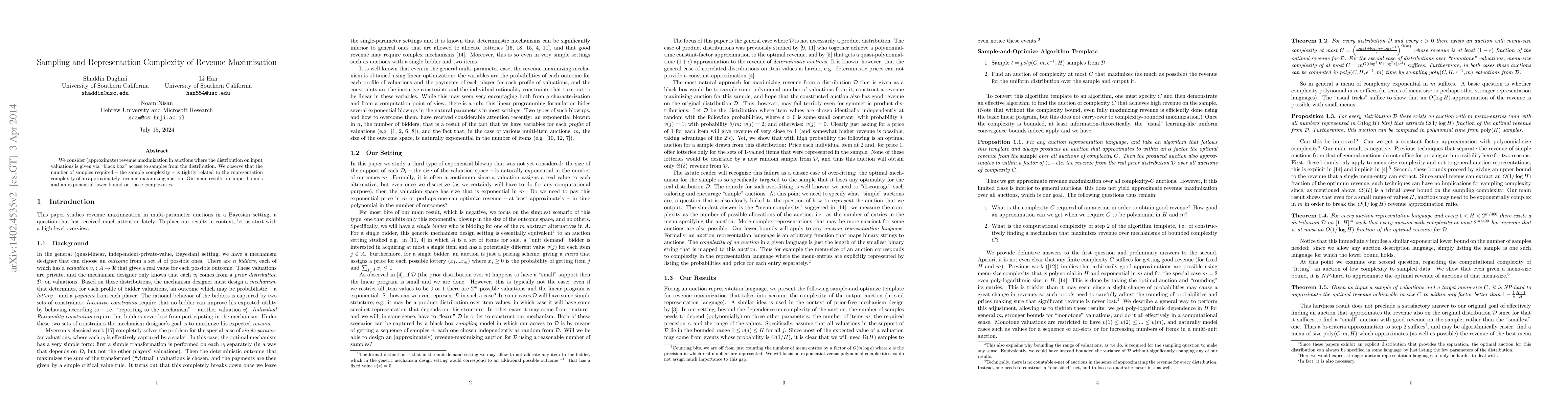

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)