Summary

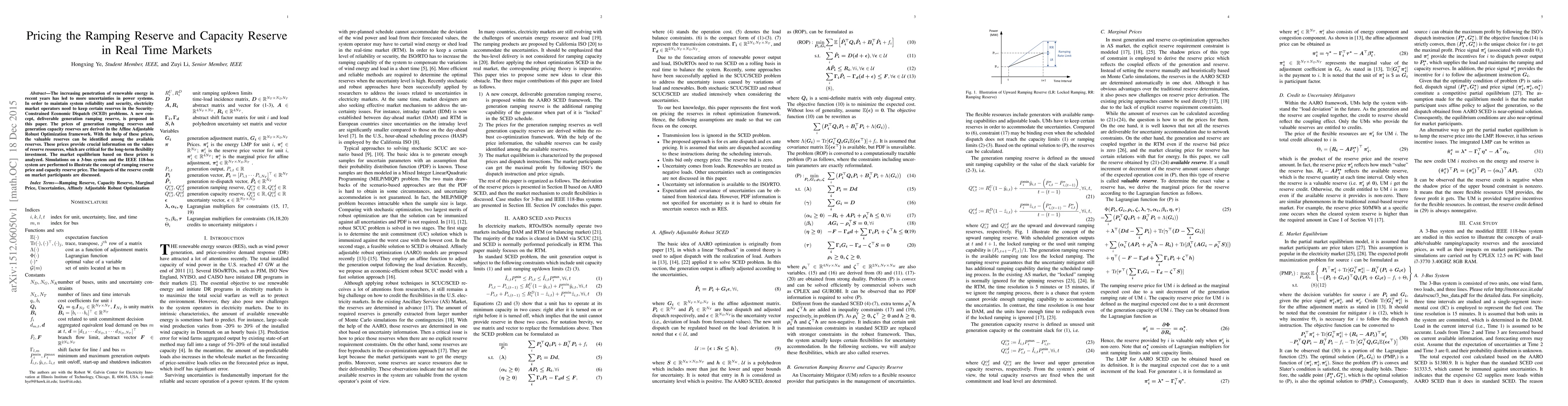

The increasing penetration of renewable energy in recent years has led to more uncertainties in power systems. In order to maintain system reliability and security, electricity market operators need to keep certain reserves in the Security-Constrained Economic Dispatch (SCED) problems. A new concept, deliverable generation ramping reserve, is proposed in this paper. The prices of generation ramping reserves and generation capacity reserves are derived in the Affine Adjustable Robust Optimization framework. With the help of these prices, the valuable reserves can be identified among the available reserves. These prices provide crucial information on the values of reserve resources, which are critical for the long-term flexibility investment. The market equilibrium based on these prices is analyzed. Simulations on a 3-bus system and the IEEE 118-bus system are performed to illustrate the concept of ramping reserve price and capacity reserve price. The impacts of the reserve credit on market participants are discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)