Summary

Pricing and settlement mechanisms are crucial for efficient re-source allocation, investment incentives, market competition, and regulatory oversight. In the United States, Regional Transmission Operators (RTOs) adopts a uniform pricing scheme that hinges on the marginal costs of supplying additional electricity. This study investigates the pricing and settlement impacts of alternative reserve constraint modeling, highlighting how even slight variations in the modeling of constraints can drastically alter market clearing prices, reserve quantities, and revenue outcomes. Focusing on the diverse market designs and assumptions in ancillary services by U.S. RTOs, particularly in relation to capacity sharing and reserve substitutions, the research examines four distinct models that combine these elements based on a large-scale synthetic power system test data. Our study provides a critical insight into the economic implications and the underlying factors of these alternative reserve constraints through market simulations and data analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

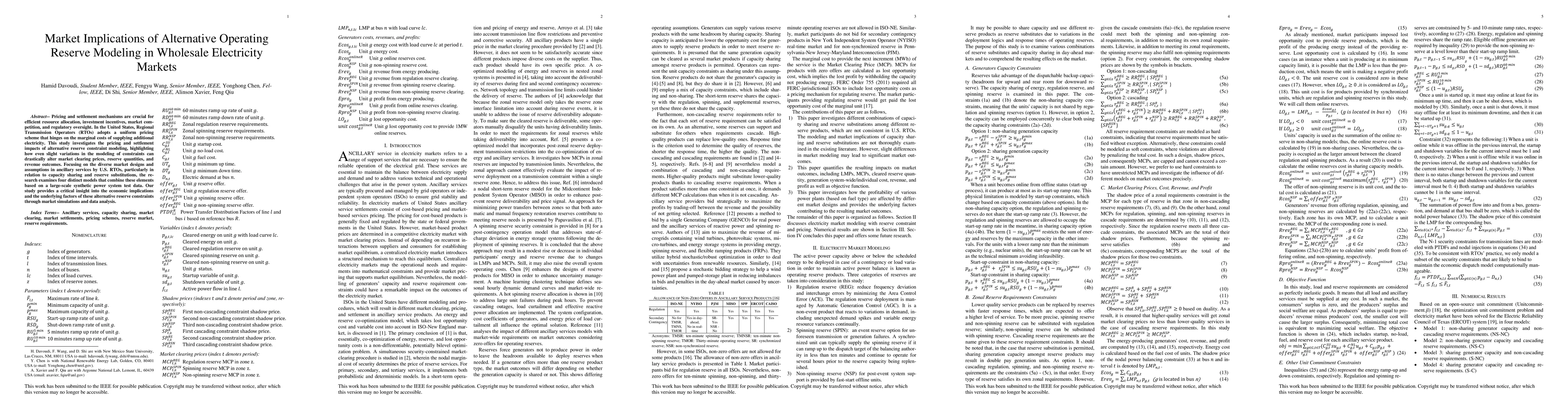

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket power abuse in wholesale electricity markets

Lynn H. Kaack, Alice Lixuan Xu, Lion Hirth et al.

Correlations and Clustering in Wholesale Electricity Markets

Francesco Caravelli, Tianyu Cui, Cozmin Ududec

No citations found for this paper.

Comments (0)