Summary

Most of the empirical studies on stochastic volatility dynamics favor the 3/2 specification over the square-root (CIR) process in the Heston model. In the context of option pricing, the 3/2 stochastic volatility model is reported to be able to capture the volatility skew evolution better than the Heston model. In this article, we make a thorough investigation on the analytic tractability of the 3/2 stochastic volatility model by proposing a closed-form formula for the partial transform of the triple joint transition density $(X,I,V)$ which stand for the log asset price, the quadratic variation (continuous realized variance) and the instantaneous variance, respectively. Two distinct formulations are provided for deriving the main result. The closed-form partial transform enables us to deduce a variety of marginal partial transforms and characteristic functions and plays a crucial role in pricing discretely sampled variance derivatives and exotic options that depend on both the asset price and quadratic variation. Various applications and numerical examples on pricing exotic derivatives with discrete monitoring feature are given to demonstrate the versatility of the partial transform under the 3/2 model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

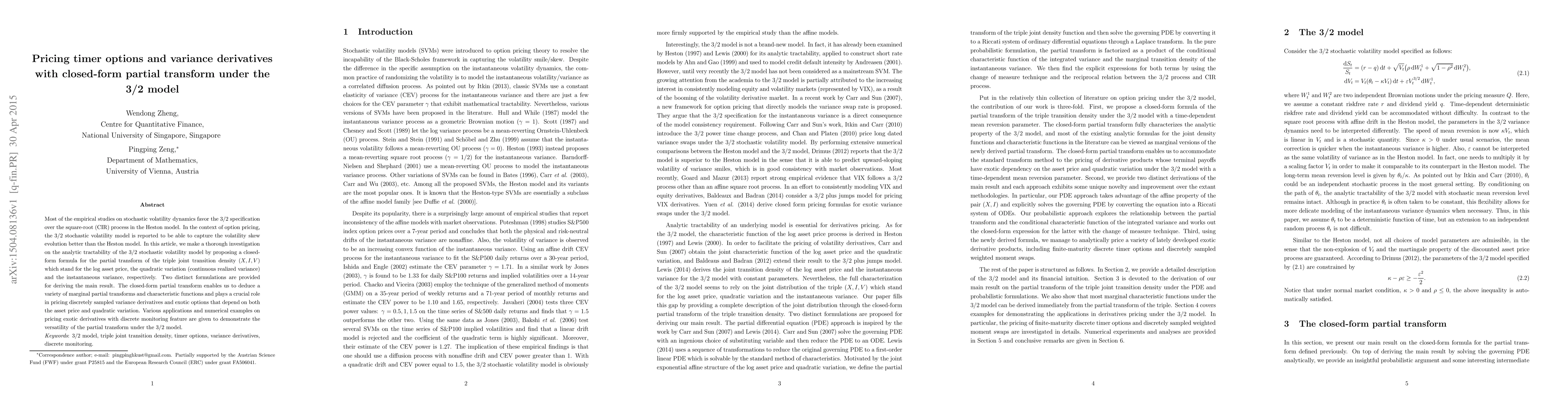

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic closed-form formulas for pricing nonlinear payoff variance and volatility derivatives under Schwartz model with time-varying log-return volatility

Phiraphat Sutthimat, Nontawat Bunchak, Udomsak Rakwongwan

| Title | Authors | Year | Actions |

|---|

Comments (0)