Authors

Summary

Transition risk can be defined as the business-risk related to the enactment of green policies, aimed at driving the society towards a sustainable and low-carbon economy. In particular, the value of certain firms' assets can be lower because they need to transition to a less carbon-intensive business model. In this paper we derive formulas for the pricing of defaultable coupon bonds and Credit Default Swaps to empirically demonstrate that a jump-diffusion credit risk model in which the downward jumps in the firm value are due to tighter green laws can capture, at least partially, the transition risk. The empirical investigation consists in the model calibration on the CDS term-structure, performing a quantile regression to assess the relationship between implied prices and a proxy of the transition risk. Additionally, we show that a model without jumps lacks this property, confirming the jump-like nature of the transition risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

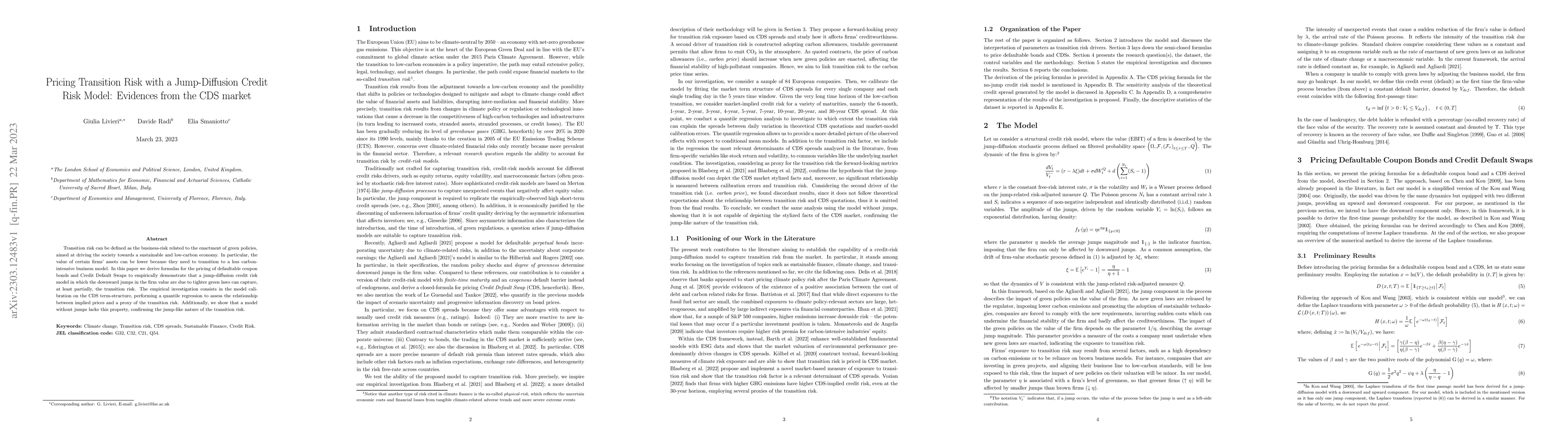

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalytical Pricing of 2 Factor Structural PDE model for a Puttable Bond with Credit Risk

Hyong Chol O, Dae Song Choe, Gyong-Dok Rim

| Title | Authors | Year | Actions |

|---|

Comments (0)