Summary

We investigate the computational aspects of the basket CDS pricing with counterparty risk under a credit contagion model of multinames. This model enables us to capture the systematic volatility increases in the market triggered by a particular bankruptcy. The drawback of this problem is its analytical complication due to its path-dependent functional, which bears a potential failure in its convergence of numerical approximation under standing assumptions. In this paper we find sufficient conditions for the desired convergence of the functionals associated with a class of path-dependent stochastic differential equations. The main ingredient is to identify the weak convergence of the approximated solution to the underlying path-dependent stochastic differential equation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

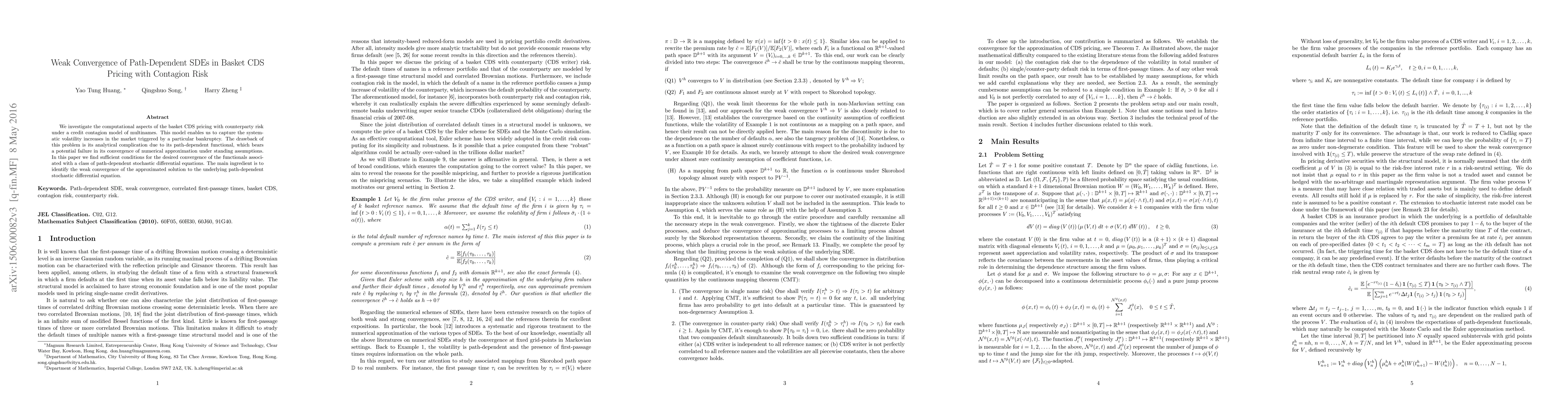

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)