Authors

Summary

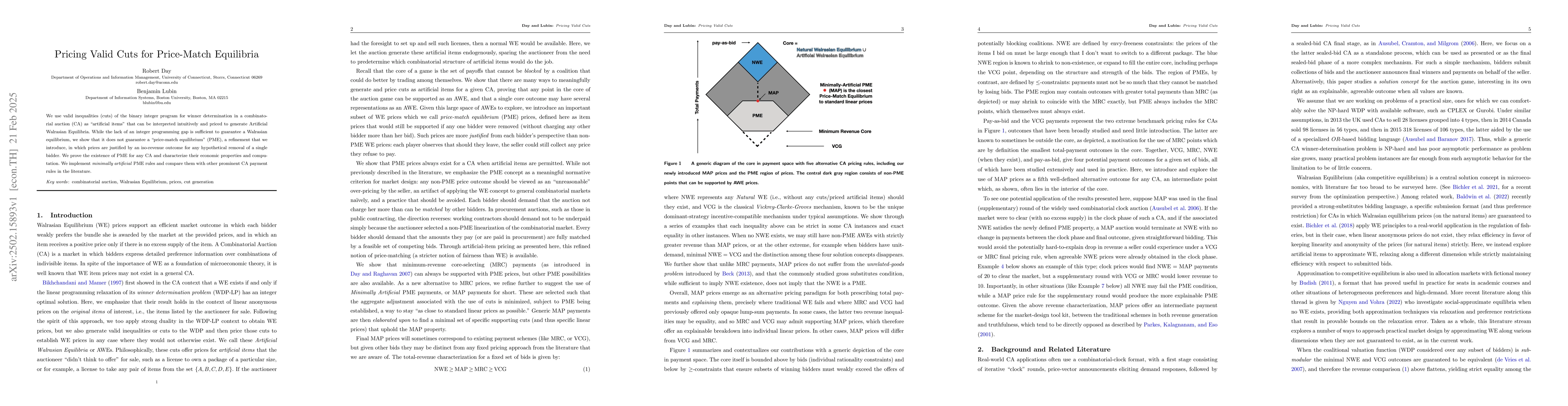

We use valid inequalities (cuts) of the binary integer program for winner determination in a combinatorial auction (CA) as "artificial items" that can be interpreted intuitively and priced to generate Artificial Walrasian Equilibria. While the lack of an integer programming gap is sufficient to guarantee a Walrasian equilibrium, we show that it does not guarantee a "price-match equilibrium" (PME), a refinement that we introduce, in which prices are justified by an iso-revenue outcome for any hypothetical removal of a single bidder. We prove the existence of PME for any CA and characterize their economic properties and computation. We implement minimally artificial PME rules and compare them with other prominent CA payment rules in the literature.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper introduces non-negative integer valid cuts for winner determination in combinatorial auctions (CA) as artificial items, interpretable and priced to generate Artificial Walrasian Equilibria (AWE). It proves the existence of Price-Match Equilibria (PME) for any CA and characterizes their economic properties and computation.

Key Results

- Existence of PME for any CA is proven.

- Characterization of economic properties and computation of PME.

- Implementation of minimally artificial PME (MAP) rules and comparison with other payment rules.

- Theorem 1 ensures that all personalized core payments can be reached via some valid cut.

- Theorem 2 guarantees that if Walrasian Equilibrium (WE) prices are not a PME, there exists a core point with lower total payments.

Significance

This research is significant as it provides a novel approach to pricing in combinatorial auctions, ensuring a balance between efficiency and fairness through the introduction of MAP prices, which are less artificial than linearized MRC payments in certain cases.

Technical Contribution

The paper introduces matrix D, allowing optimization over cuts once a solution to WDP is known, and characterizes the closure of cutting algorithms for WDP-LP, ensuring any core point can be found as an AWE point.

Novelty

The work is novel in its approach to pricing in combinatorial auctions by introducing MAP prices, which provide linear prices unlike typical MRC and VCG implementations, and are less artificial than linearized MRC payments in some cases.

Limitations

- MAP prices require the solution of several NP-hard WDPs, potentially leading to super-polynomial asymptotic performance unless P=NP.

- Computational complexity of finding Bayes-Nash equilibria under MAP pricing remains a challenging task.

Future Work

- Development of specialized algorithms for MAP pricing, both for the general problem and for specific cases.

- Numerical evaluation and behavioral studies of MAP pricing to assess its robustness to behavioral and structural assumptions.

- Exploration of dynamic MAP pricing for iterative price discovery processes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMatchDiffusion: Training-free Generation of Match-cuts

Tong Zhang, Philip Torr, Fabio Pizzati et al.

Pricing and Electric Vehicle Charging Equilibria

Chowdhury Mohammad Sakib Anwar, Trivikram Dokka, Jorge Bruno et al.

Price and Payoff Autocorrelations in a Multi-Period Consumption-Based Asset Pricing Model

Victor Olkhov

Resource-Robust Valid Inequalities for Vehicle Routing and Related Problems

Kevin Dalmeijer, Ymro N. Hoogendoorn

No citations found for this paper.

Comments (0)