Summary

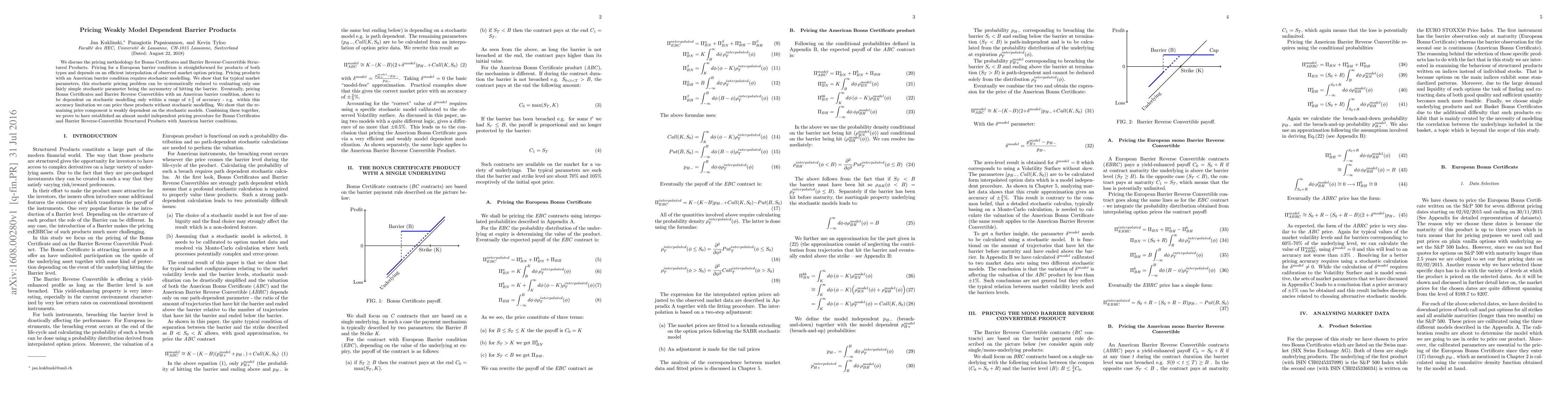

We discuss the pricing methodology for Bonus Certificates and Barrier Reverse-Convertible Structured Products. Pricing for a European barrier condition is straightforward for products of both types and depends on an efficient interpolation of observed market option pricing. Pricing products We discuss the pricing methodology for Bonus Certificates and Barrier Reverse-Convertible Structured Products. Pricing for a European barrier condition is straightforward for products of both types and depends on an efficient interpolation of observed market option pricing. Pricing products with an American barrier condition requires stochastic modelling. We show that for typical market parameters, this stochastic pricing problem can be systematically reduced to evaluating only one fairly simple stochastic parameter being the asymmetry of hitting the barrier. Eventually, pricing Bonus Certificates and Barrier Reverse Convertibles with an American barrier condition, shows to be dependent on stochastic modelling only within a range of $\pm\frac{2}{3}$ of accuracy - e.g. within this accuracy limitation we can price these products without stochastic modelling. We show that the remaining price component is weakly dependent on the stochastic models. Combining these together, we prove to have established an almost model independent pricing procedure for Bonus Certificates and Barrier Reverse-Convertible Structured Products with American barrier conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSemi-analytical pricing of barrier options in the time-dependent Heston model

A. Itkin, P. Carr, D. Muravey

Path Integral Method for Pricing Proportional Step Double-Barrier Option with Time Dependent Parameters

Qi Chen, Chao Guo

A Hamiltonian Approach to Barrier Option Pricing Under Vasicek Model

Chao Guo, Qi Chen Hong-tao Wang

No citations found for this paper.

Comments (0)