Authors

Summary

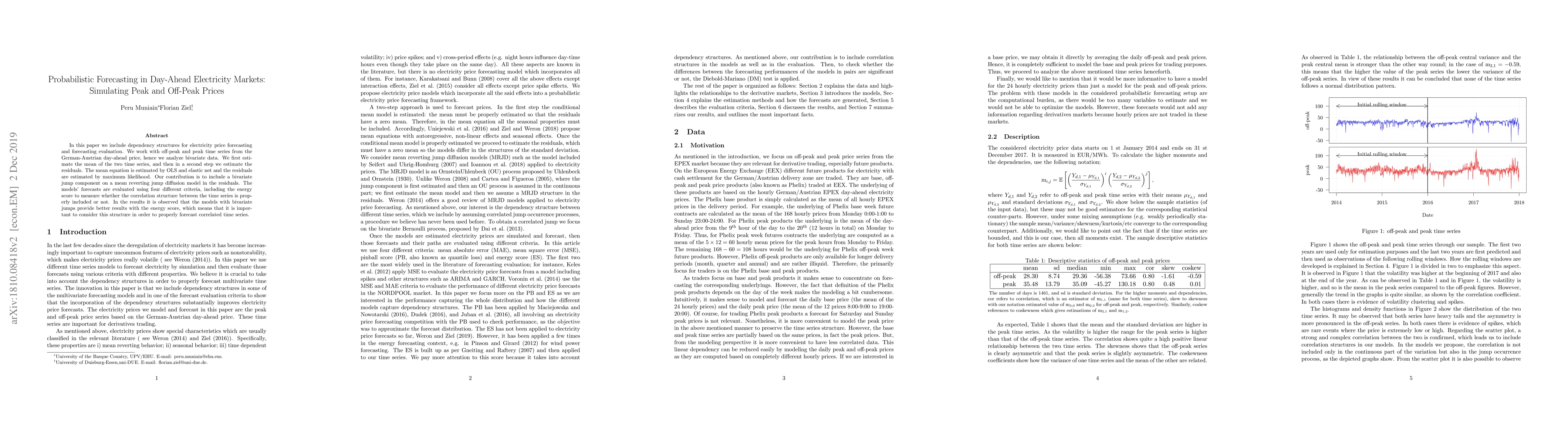

In this paper we include dependency structures for electricity price forecasting and forecasting evaluation. We work with off-peak and peak time series from the German-Austrian day-ahead price, hence we analyze bivariate data. We first estimate the mean of the two time series, and then in a second step we estimate the residuals. The mean equation is estimated by OLS and elastic net and the residuals are estimated by maximum likelihood. Our contribution is to include a bivariate jump component on a mean reverting jump diffusion model in the residuals. The models' forecasts are evaluated using four different criteria, including the energy score to measure whether the correlation structure between the time series is properly included or not. In the results it is observed that the models with bivariate jumps provide better results with the energy score, which means that it is important to consider this structure in order to properly forecast correlated time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic Forecasting of Day-Ahead Electricity Prices and their Volatility with LSTMs

Dirk Witthaut, Leonardo Rydin Gorjão, Benjamin Schäfer et al.

Multivariate Scenario Generation of Day-Ahead Electricity Prices using Normalizing Flows

Dirk Witthaut, Manuel Dahmen, Hannes Hilger et al.

Learning Probability Distributions of Day-Ahead Electricity Prices

Jozef Barunik, Lubos Hanus

| Title | Authors | Year | Actions |

|---|

Comments (0)