Summary

This paper presents a novel approach for constructing probabilistic forecasts, which combines both the Quantile Regression Averaging (QRA) method and the Principal Component Analysis (PCA) averaging scheme. The performance of the approach is evaluated on datasets from two European energy markets - the German EPEX SPOT and the Polish Power Exchange (TGE). The results indicate that newly proposed solutions yield results, which are more accurate than the literature benchmarks. Additionally, empirical evidence indicates that the proposed method outperforms its competitors in terms of the empirical coverage and the Christoffersen test. In addition, the economic value of the probabilistic forecast is evaluated on the basis of financial metrics. We test the performance of forecasting models taking into account a day-ahead market trading strategy that utilizes probabilistic price predictions and an energy storage system. The results indicate that profits of up to 10 EUR per 1 MWh transaction can be obtained when predictions are generated using the novel approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

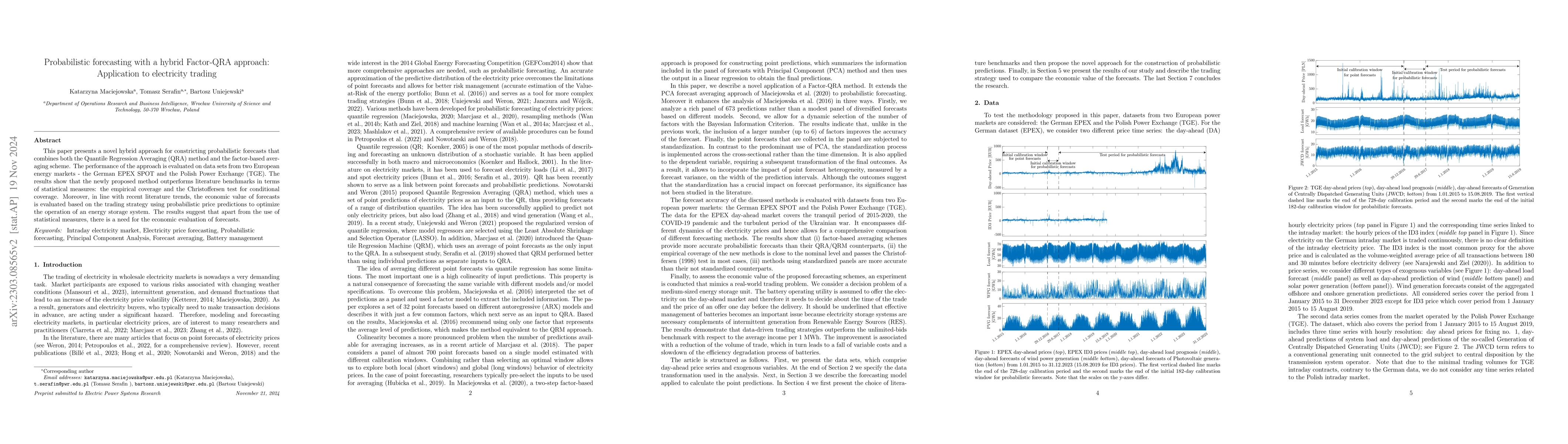

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersElectricity price forecasting with Smoothing Quantile Regression Averaging: Quantifying economic benefits of probabilistic forecasts

Bartosz Uniejewski

Expectile regression averaging method for probabilistic forecasting of electricity prices

Joanna Janczura

| Title | Authors | Year | Actions |

|---|

Comments (0)