Authors

Summary

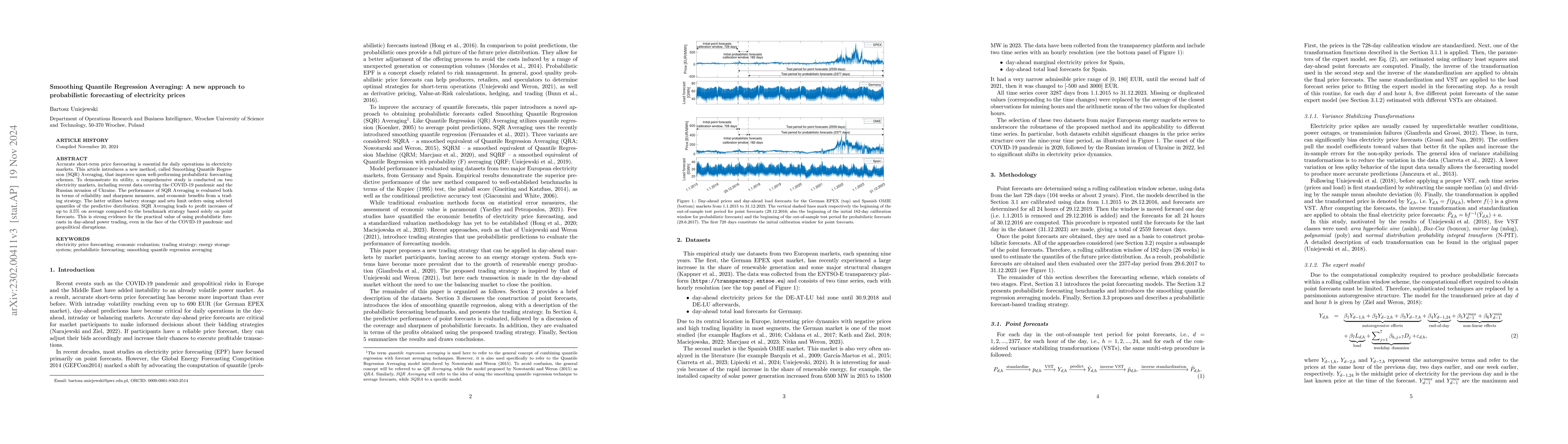

In the world of the complex power market, accurate electricity price forecasting is essential for strategic bidding and affects both daily operations and long-term investments. This article introduce a new method dubbed Smoothing Quantile Regression (SQR) Averaging, that improves on well-performing schemes for probabilistic forecasting. To showcase its utility, a comprehensive study is conducted across four power markets, including recent data encompassing the COVID-19 pandemic and the Russian invasion on Ukraine. The performance of SQR Averaging is evaluated and compared to state-of-the-art benchmark methods in terms of the reliability and sharpness measures. Additionally, an evaluation scheme is introduced to quantify the economic benefits derived from SQR Averaging predictions. This scheme can be applied in any day-ahead electricity market and is based on a trading strategy that leverages battery storage and sets limit orders using selected quantiles of the predictive distribution. The results reveal that, compared to the benchmark strategy, utilizing SQR Averaging leads to average profit increases of up to 14\%. These findings provide strong evidence for the effectiveness of SQR Averaging in improving forecast accuracy and the practical value of utilizing probabilistic forecasts in day-ahead electricity trading, even in the face of challenging events such as the COVID-19 pandemic and geopolitical disruptions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIsotonic Quantile Regression Averaging for uncertainty quantification of electricity price forecasts

Expectile regression averaging method for probabilistic forecasting of electricity prices

Joanna Janczura

Probabilistic Forecasts of Load, Solar and Wind for Electricity Price Forecasting

Florian Ziel, Bartosz Uniejewski

| Title | Authors | Year | Actions |

|---|

Comments (0)