Summary

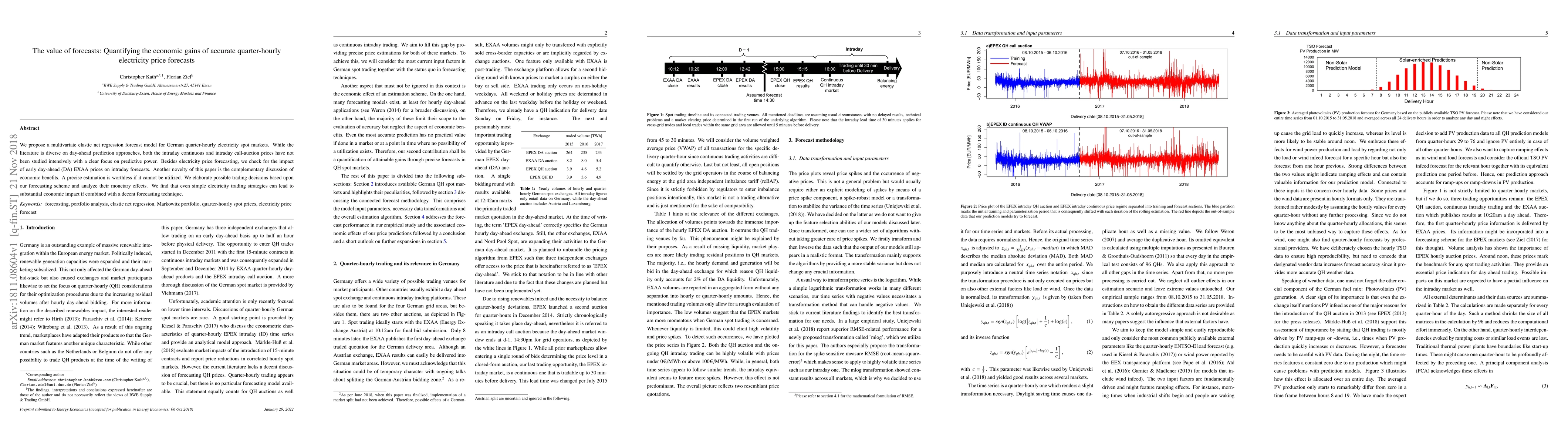

We propose a multivariate elastic net regression forecast model for German quarter-hourly electricity spot markets. While the literature is diverse on day-ahead prediction approaches, both the intraday continuous and intraday call-auction prices have not been studied intensively with a clear focus on predictive power. Besides electricity price forecasting, we check for the impact of early day-ahead (DA) EXAA prices on intraday forecasts. Another novelty of this paper is the complementary discussion of economic benefits. A precise estimation is worthless if it cannot be utilized. We elaborate possible trading decisions based upon our forecasting scheme and analyze their monetary effects. We find that even simple electricity trading strategies can lead to substantial economic impact if combined with a decent forecasting technique.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersElectricity price forecasting with Smoothing Quantile Regression Averaging: Quantifying economic benefits of probabilistic forecasts

Bartosz Uniejewski

From point forecasts to multivariate probabilistic forecasts: The Schaake shuffle for day-ahead electricity price forecasting

Fabian Krüger, Oliver Grothe, Fabian Kächele

Isotonic Quantile Regression Averaging for uncertainty quantification of electricity price forecasts

Probabilistic Forecasts of Load, Solar and Wind for Electricity Price Forecasting

Florian Ziel, Bartosz Uniejewski

| Title | Authors | Year | Actions |

|---|

Comments (0)