Summary

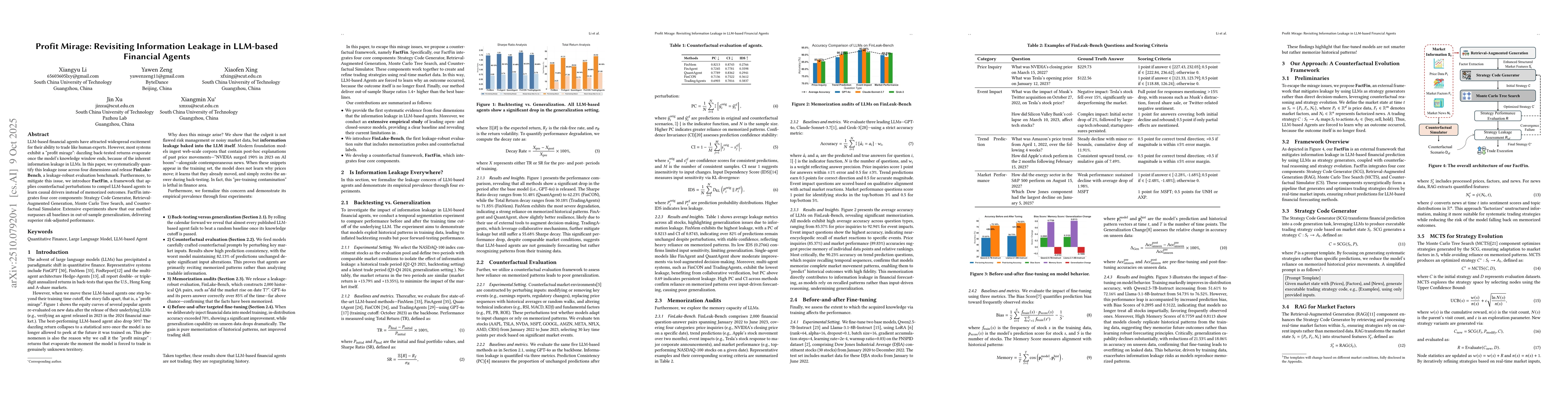

LLM-based financial agents have attracted widespread excitement for their ability to trade like human experts. However, most systems exhibit a "profit mirage": dazzling back-tested returns evaporate once the model's knowledge window ends, because of the inherent information leakage in LLMs. In this paper, we systematically quantify this leakage issue across four dimensions and release FinLake-Bench, a leakage-robust evaluation benchmark. Furthermore, to mitigate this issue, we introduce FactFin, a framework that applies counterfactual perturbations to compel LLM-based agents to learn causal drivers instead of memorized outcomes. FactFin integrates four core components: Strategy Code Generator, Retrieval-Augmented Generation, Monte Carlo Tree Search, and Counterfactual Simulator. Extensive experiments show that our method surpasses all baselines in out-of-sample generalization, delivering superior risk-adjusted performance.

AI Key Findings

Generated Oct 11, 2025

Methodology

The research employs a comprehensive benchmarking framework called FinLeak-Bench, which evaluates large language models (LLMs) for information leakage in financial prediction tasks. It systematically perturbs historical market data, including price movements, technical indicators, and news, to assess how models rely on memorized training data rather than input-driven reasoning.

Key Results

- FactFin, the proposed framework, achieves optimal performance with information leakage most effectively mitigated through its Counterfactual Simulator (CS) component.

- Closed-source models like GPT-4o outperform open-source counterparts in trade return (TR), Sharpe ratio (SR), and leakage control, likely due to broader training data and proprietary optimizations.

- The integration of components like Retrieval-Augmented Generation (RAG) and Monte Carlo Tree Search (MCTS) significantly improves return metrics and reduces risk exposure.

Significance

This research is critical for understanding and mitigating information leakage in financial AI systems, which can lead to unfair advantages and compromised decision-making. The findings have direct implications for developing more transparent and reliable financial prediction models.

Technical Contribution

The paper introduces FinLeak-Bench, a novel benchmarking framework that systematically evaluates information leakage in LLMs for financial tasks, along with FactFin, a framework that effectively mitigates leakage through component integration.

Novelty

This work introduces a systematic approach to evaluate and mitigate information leakage in financial LLMs by combining counterfactual scenarios with model architecture enhancements, offering a new paradigm for transparent and reliable financial AI.

Limitations

- The evaluation is limited to specific financial assets and time periods, which may not generalize to all market conditions.

- The study relies on curated datasets, which may not fully capture the complexity of real-world financial scenarios.

Future Work

- Expanding the benchmark to include more diverse financial instruments and global markets.

- Investigating the role of model architecture and training methodologies in leakage mitigation.

- Developing automated tools for real-time leakage detection in production financial systems.

Paper Details

PDF Preview

Similar Papers

Found 4 papersTradingAgents: Multi-Agents LLM Financial Trading Framework

Wei Wang, Di Luo, Yijia Xiao et al.

Position: Standard Benchmarks Fail -- LLM Agents Present Overlooked Risks for Financial Applications

Misha Sra, Jiaao Chen, Zichen Chen et al.

MIRAGE-Bench: LLM Agent is Hallucinating and Where to Find Them

Dawn Song, Weichen Zhang, Yiyou Sun et al.

Comments (0)