Authors

Summary

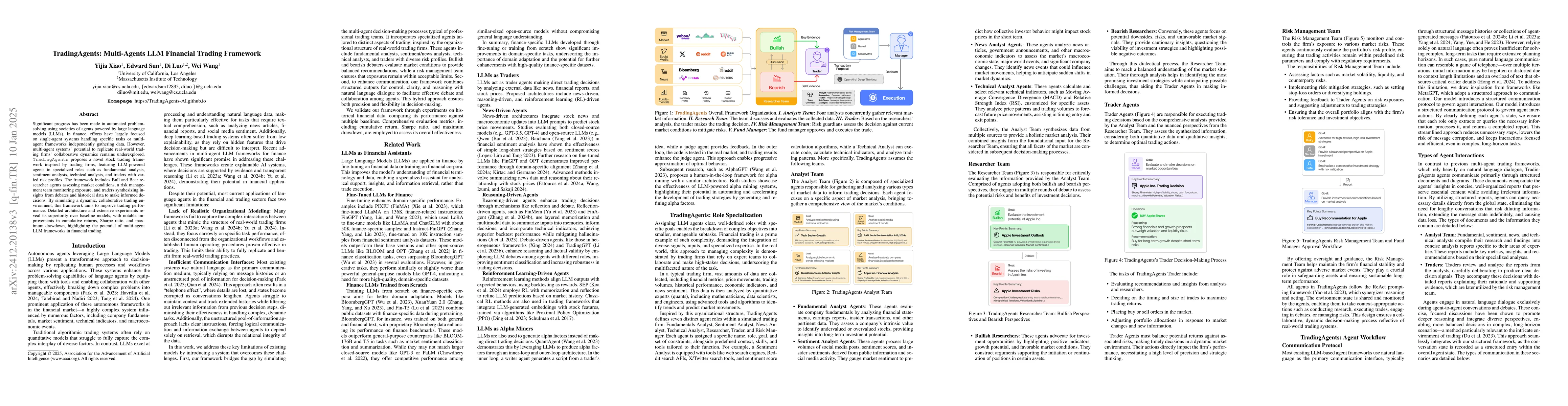

Significant progress has been made in automated problem-solving using societies of agents powered by large language models (LLMs). In finance, efforts have largely focused on single-agent systems handling specific tasks or multi-agent frameworks independently gathering data. However, multi-agent systems' potential to replicate real-world trading firms' collaborative dynamics remains underexplored. TradingAgents proposes a novel stock trading framework inspired by trading firms, featuring LLM-powered agents in specialized roles such as fundamental analysts, sentiment analysts, technical analysts, and traders with varied risk profiles. The framework includes Bull and Bear researcher agents assessing market conditions, a risk management team monitoring exposure, and traders synthesizing insights from debates and historical data to make informed decisions. By simulating a dynamic, collaborative trading environment, this framework aims to improve trading performance. Detailed architecture and extensive experiments reveal its superiority over baseline models, with notable improvements in cumulative returns, Sharpe ratio, and maximum drawdown, highlighting the potential of multi-agent LLM frameworks in financial trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading

Tianyu Shi, Hanlin Zhang, Yi Xin et al.

QuantAgents: Towards Multi-agent Financial System via Simulated Trading

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

FLAG-Trader: Fusion LLM-Agent with Gradient-based Reinforcement Learning for Financial Trading

Jimin Huang, Sophia Ananiadou, Qianqian Xie et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)